“I want to be happy” was how I replied when asked as a youth what I wanted to be in life. Likely inspired by our country’s Declaration of Independence, I bought into the enticing desire of achieving full happiness. It doesn’t work that way.

In the pursuit of a life of bliss, I read several books and listened to numerous podcasts on happiness. I was struck by the happiness science finding that 50% of a person’s happiness is based on genes, 10% individual circumstance (environment mostly out of our control), which leaves just 40% under our control. More than half of a person’s happiness (or lack thereof) is out of one’s control.

This finding is eye-opening on why happiness is so elusive for so many people. If I was born with a 5% genetic predilection to happiness, and I somehow maxed out my environmental circumstances AND all happiness related measures under my control, I could achieve a maximum of a 55% state of happiness.

That is a failing grade, and I doubt I could consistently maintain a 100% achievement of the areas in my personal control, especially when my genetic disposition was fighting against me.

I’m More of a Piglet Than a Pooh Bear.

I have found that my normal state is not one of default happiness. Do I think I am an Eeyore with a 5% genetic happiness disposition? No. But I also don’t think I’m a Pooh Bear with a 45%+ genetic good humor and gentle kindness.

Unlike Pooh, happiness doesn’t come naturally to me. I am more like a Piglet. I naturally worry. I look for security and close friendships. Sure, I’ll be brave at times with my friends, but my default is not the blissful happiness of Pooh.

Happiness carries too much weight.

I have learned that I don’t need to achieve the joy of happiness in all the day-to-day things I do or own. My wardrobe, meal, or wherever I’m staying the night isn’t responsible for my happiness, it just needs to fulfill its job. A car doesn’t need to spark joy, just get me where I need to go safely.

Happiness has a short shelf life and it is fundamentally based on comparison—with others and with personal expectations.

I think about the sheer joy my 14 year-old daughter expressed on her first business class flight experience. Through a series of crazy events, she unexpectedly was upgraded to business class flying home from Barcelona. She didn’t know until she was on the plane. She reveled over each item in the bag of sundries provided and in her ability to order all the pineapple juice she wanted. She was so grateful for the experience.

But conversely, I have seen people who travel business class frequently who complain about some aspect of the service and take the experience for granted. They have lost that first-time joy because business class has become routine.

The latter is an example of hedonic adaptation where humans will reset expectations as new experiences become expected. As we quickly adapt to life’s changes (e.g., new exciting car quickly becomes our regular car), we are continually chasing the next level item (oooh, look at that better and more expensive car!!!).

As a corollary, getting rid of unhappiness does not necessarily bring happiness. Happiness researchers share that negative emotions such as sadness and fear are necessary for survival, and that suffering is part of the human condition. Achieving 100% happiness would require humans to ignore these other important emotions and states of being. It is just not humanly possible to be fully happy all of the time, and yet we humans continue our endless pursuit of this holy grail.

The more I pursued happiness, the more elusive it became—always just around the corner, but never with me for long.

Instead, I pursue contentment.

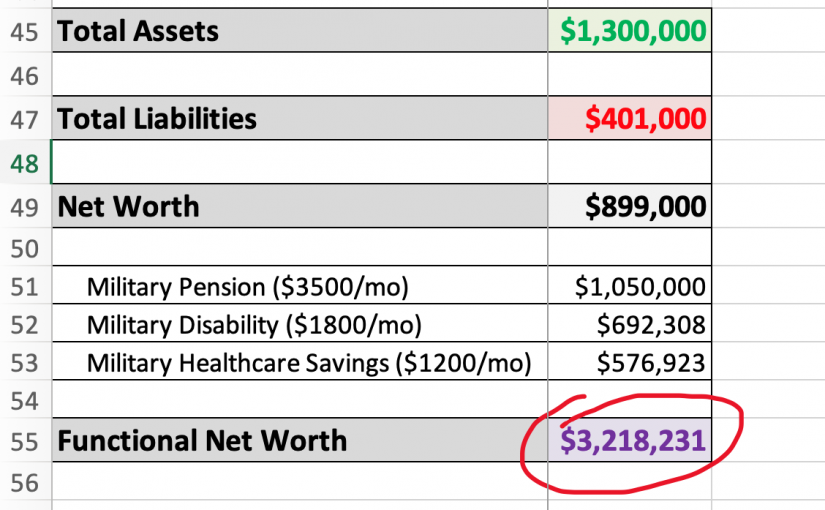

Pursuing contentment addresses the hedonic adaptation treadmill problem that the pursuit of happiness tends to create. I have determined what is enough in my life—enough money, enough stuff, enough commitments.

Minimalism was a big help in this. In embracing minimalism, I lessened the emotions and value I placed on items I owned. The things I own, such as a car, watch, clothes, boat, home, etc., are no longer symbols of myself, any of my achievements, or my love of other people. It changed who I am. I don’t need to dress nice for other people. I don’t need new things to impress others.

I also fluctuate my life’s experiences to help me maintain an appreciation for the lucky life that I live. In the past year as a full-time nomad, I have slept on an inflatable camping mattress, two bunk beds, a rock-hard bed that made my hips ache, and several gigantic and comfortable king beds, and many beds in between (62 in all).

The variation keeps my perspective in check. If the bed does its job, then I am content with that. I don’t need an incredible bed every night to appreciate my daily life. The same applies to my food, clothes, transportation, and excursions.

Instead of asking myself “Am I happy?” I ask myself “Do I have what I need?” The bar for responses to the latter question is much lower, and I achieve contentment at a far higher rate than happiness. Attaining 100% contentment feels achievable in a way attaining 100% happiness never has.

Of course, I still feel many moments of happiness as I sit on a dune in the Sahara desert in Morocco or hike along a Roman road to the Bachkovo Monastery in Bulgaria, but these highs are no longer my measure for daily success. I instead measure my daily success by my level of contentment—having enough to meet my needs and pausing to notice that.

Recently, I had a nice take-out meal from Seven Eleven in Japan and I enjoyed it in a park with my wife. Nothing fancy. We had lots of ants join us. There were lots of weeds around. My seat on the concrete step was hard. The sky was beautiful. The mountains in the distance were nice. The buildings around us were interesting.

Was I happy? Maybe. Was I content? Fully.

[This post was republished on the minimalism and simple living blog No Sidebar.]