- FI Needs the RE!

by Justin @ LivingTheFIghLifeThe (ability to) retire early part is the primary thing that makes the Financial Independence Retire Early (FIRE) community different from all the other personal finance approaches. We CAN retire early, and we as a community should own it. The following chart illustrates how FIRE principles compare to that of other, non-FIRE personal finance voices: … Continue reading FI Needs the RE!

by Justin @ LivingTheFIghLifeThe (ability to) retire early part is the primary thing that makes the Financial Independence Retire Early (FIRE) community different from all the other personal finance approaches. We CAN retire early, and we as a community should own it. The following chart illustrates how FIRE principles compare to that of other, non-FIRE personal finance voices: … Continue reading FI Needs the RE! - Frugality Increases Happiness

by Justin @ LivingTheFIghLifeAnd as a corollary, frugality does not mean deprivation, suffering, or unhappiness. Spending more does not equal more happiness just as spending less does not equal less happiness. While frugality is core to how we achieve FIRE, it does not have to mean a life of deprivation. The FIRE community is too creative for that. Setting … Continue reading Frugality Increases Happiness

by Justin @ LivingTheFIghLifeAnd as a corollary, frugality does not mean deprivation, suffering, or unhappiness. Spending more does not equal more happiness just as spending less does not equal less happiness. While frugality is core to how we achieve FIRE, it does not have to mean a life of deprivation. The FIRE community is too creative for that. Setting … Continue reading Frugality Increases Happiness - Is The Stock Market Becoming a Ponzi Scheme?

by Justin @ LivingTheFIghLifeThe convergence of the widespread use of 401k and similar retirement accounts coupled with the rise in index fund investing has created a Ponzi scheme-like dynamic with the stock market over the past 30+ years.. What is a Ponzi scheme? From Wikipedia, a Ponzi scheme “is a form of fraud that lures investors and pays … Continue reading Is The Stock Market Becoming a Ponzi Scheme?

by Justin @ LivingTheFIghLifeThe convergence of the widespread use of 401k and similar retirement accounts coupled with the rise in index fund investing has created a Ponzi scheme-like dynamic with the stock market over the past 30+ years.. What is a Ponzi scheme? From Wikipedia, a Ponzi scheme “is a form of fraud that lures investors and pays … Continue reading Is The Stock Market Becoming a Ponzi Scheme? - My Top 10 Accounting Principles for Everyday Life

by Justin @ LivingTheFIghLifeAccounting helps businesses track and organize financial information so business leaders can make informed decisions. Similarly in personal finance we all implement some level of accounting to help manage our finances to track, budget, spend, save, invest and file taxes. In a past life I managed multi-million dollar businesses with complex financial statements and taught … Continue reading My Top 10 Accounting Principles for Everyday Life

by Justin @ LivingTheFIghLifeAccounting helps businesses track and organize financial information so business leaders can make informed decisions. Similarly in personal finance we all implement some level of accounting to help manage our finances to track, budget, spend, save, invest and file taxes. In a past life I managed multi-million dollar businesses with complex financial statements and taught … Continue reading My Top 10 Accounting Principles for Everyday Life - Minimalism Changed Who I Am.

by Justin @ LivingTheFIghLifeI used to be a (aspiring) musician, cyclist, gardener, canner, soccer coach, coin collector, stamp collector, home owner, and DIY handyman. I am no longer those things. I found that by selling, giving away, or otherwise disposing of my guitars, soccer gear, biking gear, coin and stamp collections, work files, house, and many, many, other … Continue reading Minimalism Changed Who I Am.

by Justin @ LivingTheFIghLifeI used to be a (aspiring) musician, cyclist, gardener, canner, soccer coach, coin collector, stamp collector, home owner, and DIY handyman. I am no longer those things. I found that by selling, giving away, or otherwise disposing of my guitars, soccer gear, biking gear, coin and stamp collections, work files, house, and many, many, other … Continue reading Minimalism Changed Who I Am. - Has the FIRE movement lost its way?

by Justin @ LivingTheFIghLifeIn a recent episode of ChooseFI podcast (a favorite of mine), a visiting host (Katie, from MoneyWithKatie.com) talked about buying “a very nice car [a pre-owned Porsche Macan with 8,000 miles].” She was quick to acknowledge that this decision was “breaking the cardinal sin of FI/RE” but the main ChooseFI host, Brad, quickly said that … Continue reading Has the FIRE movement lost its way?

by Justin @ LivingTheFIghLifeIn a recent episode of ChooseFI podcast (a favorite of mine), a visiting host (Katie, from MoneyWithKatie.com) talked about buying “a very nice car [a pre-owned Porsche Macan with 8,000 miles].” She was quick to acknowledge that this decision was “breaking the cardinal sin of FI/RE” but the main ChooseFI host, Brad, quickly said that … Continue reading Has the FIRE movement lost its way? - Rent vs. Buy: the Power of Inflation (and a fairer calculation)

by Justin @ LivingTheFIghLifeThe FIRE community talks a lot about the rent vs. buy discussion. Which is the optimal financial decision for your personal housing and how to calculate that? While there is great information out there to help you decide, I see two important considerations often left out of these discussion: (1) Many compare a short horizon … Continue reading Rent vs. Buy: the Power of Inflation (and a fairer calculation)

by Justin @ LivingTheFIghLifeThe FIRE community talks a lot about the rent vs. buy discussion. Which is the optimal financial decision for your personal housing and how to calculate that? While there is great information out there to help you decide, I see two important considerations often left out of these discussion: (1) Many compare a short horizon … Continue reading Rent vs. Buy: the Power of Inflation (and a fairer calculation) - Home Exchanging: A Great Way to See the World

by Justin @ LivingTheFIghLifeSince 2013, we have exchanged our Arlington, VA home 8* times (with several more planned exchanges foiled by the pandemic). We exchanged with families in Paris, Barcelona, Montreal, and Iceland, to name a few. With the world opening back up, this is a good time to share what is great about a home exchange experience. … Continue reading Home Exchanging: A Great Way to See the World

by Justin @ LivingTheFIghLifeSince 2013, we have exchanged our Arlington, VA home 8* times (with several more planned exchanges foiled by the pandemic). We exchanged with families in Paris, Barcelona, Montreal, and Iceland, to name a few. With the world opening back up, this is a good time to share what is great about a home exchange experience. … Continue reading Home Exchanging: A Great Way to See the World - Calculating Functional Net Worth

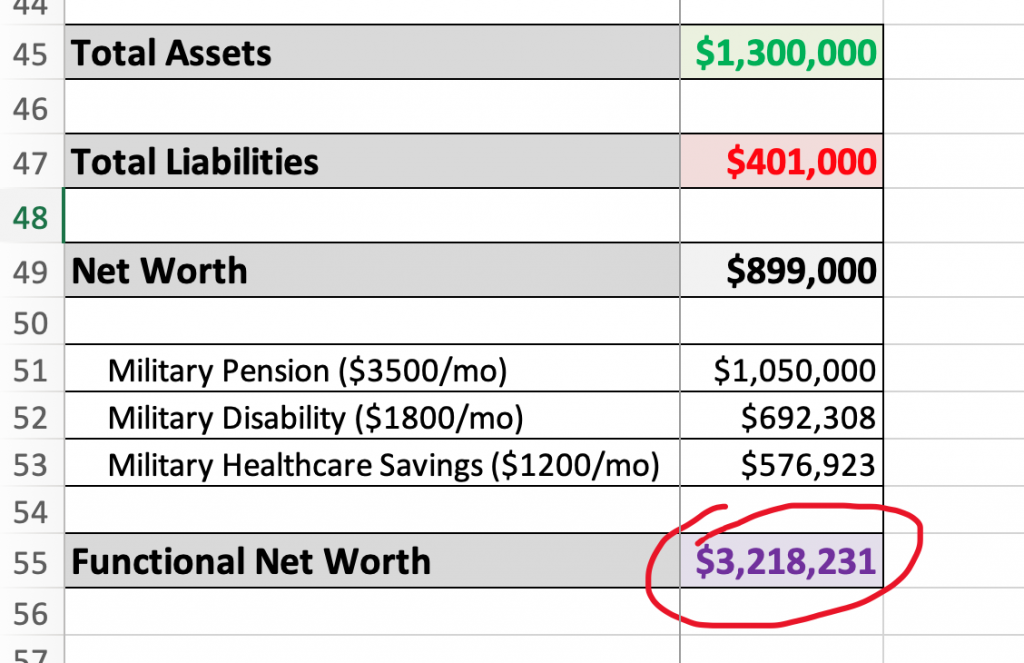

by Justin @ LivingTheFIghLifeNet worth is a key measure of building wealth. I have been calculating my net worth since 2011 so I can see my progress over time, and it’s a really useful tool. Many people are familiar with calculating their net worth: you add up the value of all of your assets (e.g., stocks, bonds, real … Continue reading Calculating Functional Net Worth

by Justin @ LivingTheFIghLifeNet worth is a key measure of building wealth. I have been calculating my net worth since 2011 so I can see my progress over time, and it’s a really useful tool. Many people are familiar with calculating their net worth: you add up the value of all of your assets (e.g., stocks, bonds, real … Continue reading Calculating Functional Net Worth - The Meaning of “Millionaire”

by Justin @ LivingTheFIghLifeWhen host Regis Philbin asked his game show contestants and audience “who wants to be a millionaire?,” he tapped into a belief many of us learned as children, that a million dollars was the pinnacle of financial success. I grew up on the rural eastern side of Washington State, and many people I knew were … Continue reading The Meaning of “Millionaire”

by Justin @ LivingTheFIghLifeWhen host Regis Philbin asked his game show contestants and audience “who wants to be a millionaire?,” he tapped into a belief many of us learned as children, that a million dollars was the pinnacle of financial success. I grew up on the rural eastern side of Washington State, and many people I knew were … Continue reading The Meaning of “Millionaire” - Taking the Leap — Living The FIgh Life

by Justin @ LivingTheFIghLifeOn August 28, 2020 at 5:47 pm, at age 52, I declared my financial independence (FI), packed up my personal belongings and left my GS-15 job at the Department of Defense after 9 years of civil service and 20 years of active duty. How was I feeling? As you can see from the below video, … Continue reading Taking the Leap — Living The FIgh Life

by Justin @ LivingTheFIghLifeOn August 28, 2020 at 5:47 pm, at age 52, I declared my financial independence (FI), packed up my personal belongings and left my GS-15 job at the Department of Defense after 9 years of civil service and 20 years of active duty. How was I feeling? As you can see from the below video, … Continue reading Taking the Leap — Living The FIgh Life - “SBP v. Term Insurance?” Is the Wrong Question

by Justin @ LivingTheFIghLifeI often hear (and read) discussions about choosing either the military Survivor Benefit Plan (SBP) or term life insurance to help the surviving spouse remain financially secure. This is comparing the wrong two things. While both term life insurance and the SBP are insurance products, they are designed for different purposes. When deciding whether to … Continue reading “SBP v. Term Insurance?” Is the Wrong Question

by Justin @ LivingTheFIghLifeI often hear (and read) discussions about choosing either the military Survivor Benefit Plan (SBP) or term life insurance to help the surviving spouse remain financially secure. This is comparing the wrong two things. While both term life insurance and the SBP are insurance products, they are designed for different purposes. When deciding whether to … Continue reading “SBP v. Term Insurance?” Is the Wrong Question - After Almost Two Decades of Investing, Why Weren’t We Rich or at Least Well on Our Way?

by Justin @ LivingTheFIghLifeI thought my wife and I were doing everything right to achieve a rich, free life. Avoid debt – check! Spend less than we earn – check! Invest the surplus – check! So, after almost two decades of investing, why weren’t we rich or at least well on our way? When I calculated our net … Continue reading After Almost Two Decades of Investing, Why Weren’t We Rich or at Least Well on Our Way?

by Justin @ LivingTheFIghLifeI thought my wife and I were doing everything right to achieve a rich, free life. Avoid debt – check! Spend less than we earn – check! Invest the surplus – check! So, after almost two decades of investing, why weren’t we rich or at least well on our way? When I calculated our net … Continue reading After Almost Two Decades of Investing, Why Weren’t We Rich or at Least Well on Our Way?