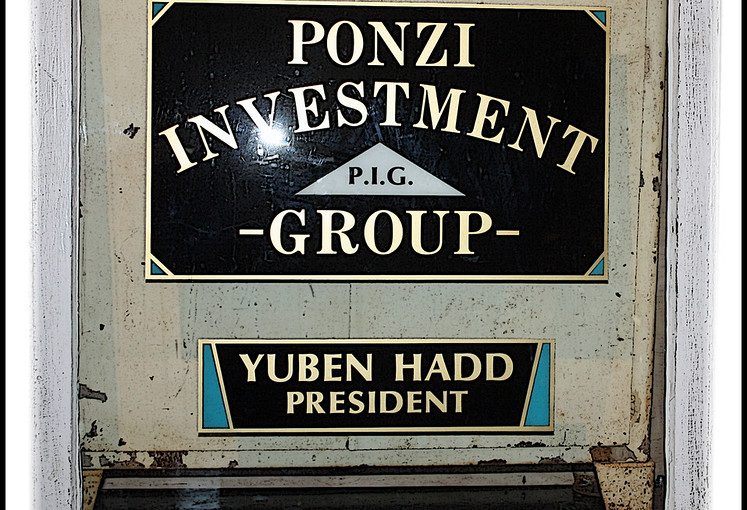

The convergence of the widespread use of 401k and similar retirement accounts coupled with the rise in index fund investing has created a Ponzi scheme-like dynamic with the stock market over the past 30+ years..

What is a Ponzi scheme?

From Wikipedia, a Ponzi scheme “is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors.” Is the stock market truly a Ponzi scheme? No, but since 1980 it has taken on some similarities with a Ponzi scheme that investors should be aware of.

Stock Market Valuation to Scale

Most graphics of the stock market (the Dow Jones Industrial Average) that include performance data before the 1980s, use a logarithmic scale. The log scale distorts the long-term variations in market value to make it appear that the changes over time are more consistent. On the chart below which uses a logarithmic scale, it visually doesn’t look like anything unusual happened around 1980. The only sizable blip in the trend is the Great Depression.

Source: https://www.macrotrends.net/1319/dow-jones-100-year-historical-chart

A couple of years ago, I stumbled across an unusual graphic of the stock market’s historical performance that surprised me because it was to scale.

Source: https://www.macrotrends.net/1319/dow-jones-100-year-historical-chart

I was shocked to see that, relative to the performance in the last three decades, the previous eight decades were basically flat to include the Great Depression (now a very minor blip on the chart) and the industrial economic growth of the 50s and 60s. I wondered what happened around 1980 that exponentially changed the dynamics for stock market valuation.

What Happened Around 1980?

Four major things: 1) invention of index funds (1971), 2) Individual Retirement Accounts or IRAs (1974), 3) the 401k plan (1978), and 4) increased institutional investment of pensions in the stock market. (Note that for this post I am using “401k” to mean all similar plans to include 401a, 403b, 457b, and the Thrift Savings Plan (TSP).)

Jack Bogle invented index funds well before 1980, but they did not take off on a mega-scale until the 401k, IRAs, and remaining pension plans began growing in number and size and therefore dramatically increased their share of the stock market.

Section 401k of the Revenue Act, which became the namesake for the retirement accounts it authorized, was passed on November 6, 1978. The first 401k plan was implemented 3 weeks later. Since then, public and private employers have gutted the traditional pension plan. Employers have either replaced pensions entirely with a 401k (sometimes with matching funds), or they (often government entities) have deeply cut the value of their pension plans and then offered a 401k option to help offset the lost value.

According to a 2021 CNBC article, “401(k) and other defined-contribution plans like it quickly replaced traditional pension plans. From 1980 through 2008, participants in pension plans fell from 38% to 20% of the U.S. workforce, while employees covered by defined-contribution plans jumped from 8% to 31%, according to the Bureau of Labor Statistics.”

Even though the number and dollar value of pensions has sharply declined since 1978, they still represented 10% of stock market value as of October 2020.

So How Does This Create Ponzi Scheme Dynamics?

According to Annie Lowrey in an April 2021 Atlantic article, “[s]ome $11 trillion is now invested in index funds, up from $2 trillion a decade ago. And as of 2019, more money is invested in passive funds than in active funds in the United States.”

The issue here is that index fund investing works differently than other types of investments. Most IRA, 401k, and pension accounts invest in index funds each month regardless of the performance of the market or any particular company in the market.

Index funds are cap-weighted, meaning that if a large company like Google represents 5% of the value of the index (e.g. S&P 500) then every month passive investors (i.e., everyone with a 401k in the stock market) will invest 5% of their monthly retirement dollars on Google whether or not Google is a good investment right then. This monthly automaticity arbitrarily drives up the price of Google stock because the index must buy the stocks in the index at their cap weight. Likewise, every other company’s stocks in an index are also purchased independent of performance.

Many stock investors, especially those investing for retirement, are not selling their shares each month when these new index investment purchases need to be made. They want to avoid stock market volatility. This dynamic creates supply and demand price pressures that help keep the valuations going up.

The growing demand for index fund investments drives up the valuation of the stock market. This helps explain, at least in part, the meteoric rise of the stock market’s valuation over the last three decades.

It doesn’t matter if the company is actually worth what its stock is valued at as long as investors keep passively buying the stock at a high price and driving it higher. And if this dynamic sounds familiar, it is: this is similar to how new investors in a Ponzi scheme keep the returns high for the older scheme participants.

The expansion of retirement account vehicles like the IRA and 401k, with their strong tax incentives coupled with the increased ease and lower costs of stock investing, have helped this trend grow. The big question is, when will the new money stop rolling in every month and the first investors start selling off more than they are investing? This turn of events could cause a partial collapse of stock valuation, create great losses, and leave the more recent investors waiting for long-term returns holding the bag – again, similar to the effects of a Ponzi scheme collapse.

It’s Not Really a Ponzi Scheme, Right?

Right. A Ponzi scheme is illegal, and there is nothing illegal about the investment vehicles I’ve just described. BUT, there are some Ponzi scheme dynamics at play in today’s market. I recognize that a large part of the amazing overall stock performance that I have enjoyed over the last three decades, particularly since 2009, is in no small part due to my fellow index fund investors who continue to invest in the stock market every month, regardless of performance.

While the stock market will continue to respond positively and negatively to economic events (e.g., COVID-19, an oil crisis, AI, interest rates, etc.), market drops are dampened and gains are propelled by the drumbeat of the monthly capital infusions from index funds.

I agree with the MorningStar MarketWatch assessment that the market is overvalued based on any measure. Much of this overvaluation can be attributed to the relentless monthly retirement stock investments (passive and active). This overvaluation should not pose a problem unless (until?) the infusions of new investments in the market become significantly less than the amounts being withdrawn by investors over a prolonged period.

To prevent this devaluation, we “older” investors need to keep encouraging new index fund investing among our fellow citizens until we have sold our shares. Then those investors will need to encourage future generations to do the same. The current structure of the stock market will continue to need new investors, investing monthly regardless of individual stocks’ performances, to keep that line on the graph moving upward.

So while I remain fully invested in the stock market, I also remain vigilant to mega trends that might indicate the tide is turning on the Ponzi-esque dynamics on the market from index fund investing.

Thanks for reading! If you would like to be notified of new posts or updates from Living The FIgh Life, please subscribe below. I am an inconsistent blogger (hey, I'm retired!) so this is the best way to be notified of new content. Cheers!

![]()

Good read Justin.

Thanks!