- “Don’t Touch My Coffee!”: Addressing Distortion of the Latté Factor and Why It Remains a Powerful Tool

by Justin @ LivingTheFIghLifeI have noticed a trend in personal finance circles distorting the concept of the “latté factor” which I mentioned in my article “Has the FIRE Movement Lost Its Way?” but I believe needs to be addressed directly. As a quick primer, the latté factor was made popular by personal finance author David Bach in his book … Continue reading “Don’t Touch My Coffee!”: Addressing Distortion of the Latté Factor and Why It Remains a Powerful Tool

by Justin @ LivingTheFIghLifeI have noticed a trend in personal finance circles distorting the concept of the “latté factor” which I mentioned in my article “Has the FIRE Movement Lost Its Way?” but I believe needs to be addressed directly. As a quick primer, the latté factor was made popular by personal finance author David Bach in his book … Continue reading “Don’t Touch My Coffee!”: Addressing Distortion of the Latté Factor and Why It Remains a Powerful Tool - Skills are Assets: Six Reasons to Do-It-Yourself

by Justin @ LivingTheFIghLifeMy dad was a “jack of all trades,” and there was little he couldn’t do himself. He made his own soap, handmade moccasins from a bear hide he tanned himself, reupholstered furniture, built a barn, a double-axle trailer (did all his own welding), laid bricks, rebuilt a carburetor, kept bees, added a bedroom and bath … Continue reading Skills are Assets: Six Reasons to Do-It-Yourself

by Justin @ LivingTheFIghLifeMy dad was a “jack of all trades,” and there was little he couldn’t do himself. He made his own soap, handmade moccasins from a bear hide he tanned himself, reupholstered furniture, built a barn, a double-axle trailer (did all his own welding), laid bricks, rebuilt a carburetor, kept bees, added a bedroom and bath … Continue reading Skills are Assets: Six Reasons to Do-It-Yourself - The Tyranny of Convenience

by Justin @ LivingTheFIghLifeWouldn’t it be great if we had a machine that would save us the trouble of hanging up our clothes on a line to dry? No more waiting numerous hours, often overnight, before the clothes are dry and ready to fold and put away? We could save that time with the right machine. All we’d … Continue reading The Tyranny of Convenience

by Justin @ LivingTheFIghLifeWouldn’t it be great if we had a machine that would save us the trouble of hanging up our clothes on a line to dry? No more waiting numerous hours, often overnight, before the clothes are dry and ready to fold and put away? We could save that time with the right machine. All we’d … Continue reading The Tyranny of Convenience - 8 Lessons I Have Learned After 5 Years as an Early Retiree

by Justin @ LivingTheFIghLifeFive years ago, I took the leap to retire early—fifteen years before Social Security’s full-retirement age. I left my career as a civil servant at the Department of Defense at its peak—not just in terms of my highest compensation but also my greatest influence and status. And yet, it was one of the best decisions … Continue reading 8 Lessons I Have Learned After 5 Years as an Early Retiree

by Justin @ LivingTheFIghLifeFive years ago, I took the leap to retire early—fifteen years before Social Security’s full-retirement age. I left my career as a civil servant at the Department of Defense at its peak—not just in terms of my highest compensation but also my greatest influence and status. And yet, it was one of the best decisions … Continue reading 8 Lessons I Have Learned After 5 Years as an Early Retiree - Happiness in Early Retirement Isn’t Rare

by Justin @ LivingTheFIghLifeI enjoy the work published on No Sidebar. It is one of the few blogs I regularly follow and I have been honored to have a few of my pieces published there. It has a large reach and positive influence in the minimalism and simple living community. Recently, however, I felt I needed to provide … Continue reading Happiness in Early Retirement Isn’t Rare

by Justin @ LivingTheFIghLifeI enjoy the work published on No Sidebar. It is one of the few blogs I regularly follow and I have been honored to have a few of my pieces published there. It has a large reach and positive influence in the minimalism and simple living community. Recently, however, I felt I needed to provide … Continue reading Happiness in Early Retirement Isn’t Rare - How the Sunk Cost Fallacy Impacts What We Own and Do

by Justin @ LivingTheFIghLifeI once spent several hundred dollars on a high quality bike rack. It held four bikes, and there were four of us. It seemed like a great investment to increase our family biking time. But pretty quickly I found it was too unwieldy to use. I only used it twice and hated it both times. … Continue reading How the Sunk Cost Fallacy Impacts What We Own and Do

by Justin @ LivingTheFIghLifeI once spent several hundred dollars on a high quality bike rack. It held four bikes, and there were four of us. It seemed like a great investment to increase our family biking time. But pretty quickly I found it was too unwieldy to use. I only used it twice and hated it both times. … Continue reading How the Sunk Cost Fallacy Impacts What We Own and Do - What If One of Us Dies? Stress Testing Our Early Retirement Plan

by Justin @ LivingTheFIghLifeSeveral prominent early retirees have shared their challenges with life-changing events to include divorces, major medical surprises, and death of a spouse. While these events have a low chance of occurring for most early retirees, the impact of these events could derail our retirement plans. Some early retirees had to return to full-time employment as … Continue reading What If One of Us Dies? Stress Testing Our Early Retirement Plan

by Justin @ LivingTheFIghLifeSeveral prominent early retirees have shared their challenges with life-changing events to include divorces, major medical surprises, and death of a spouse. While these events have a low chance of occurring for most early retirees, the impact of these events could derail our retirement plans. Some early retirees had to return to full-time employment as … Continue reading What If One of Us Dies? Stress Testing Our Early Retirement Plan - 10 Things I Have Learned From Two Years Of Slow-Traveling The World Full-time

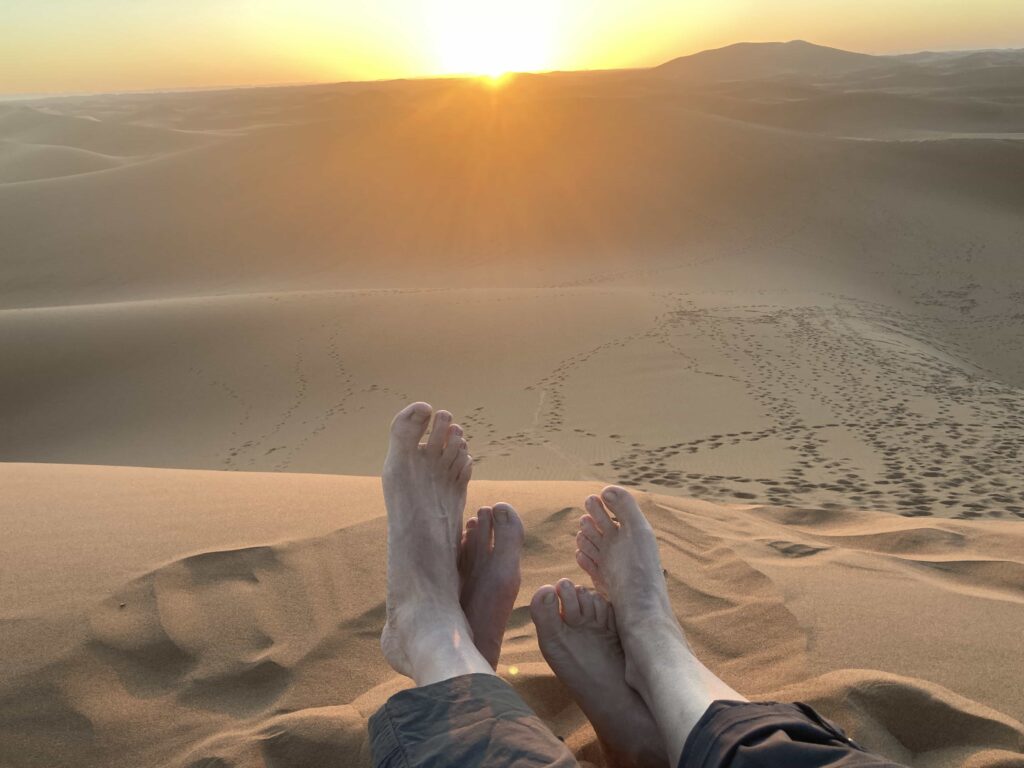

by Justin @ LivingTheFIghLifeLauna and I celebrated our second anniversary of nomadic travel this month. It has been an incredible life experience so far with so much more to see and do in the world. After letting go of 98% of our possessions and turning our house into our second rental unit, we embarked on a full-time nomadic … Continue reading 10 Things I Have Learned From Two Years Of Slow-Traveling The World Full-time

by Justin @ LivingTheFIghLifeLauna and I celebrated our second anniversary of nomadic travel this month. It has been an incredible life experience so far with so much more to see and do in the world. After letting go of 98% of our possessions and turning our house into our second rental unit, we embarked on a full-time nomadic … Continue reading 10 Things I Have Learned From Two Years Of Slow-Traveling The World Full-time - How Frugality Made My Life Happier

by Justin @ LivingTheFIghLifeMy wife (a public school teacher) and I (a government employee) both achieved financial independence and retired at the age of 52, or 15 years before Social Security’s full retirement age. Coming when we are still able-bodied and relatively healthy, that 15 years represents a lot of time to follow our curiosities. [This article was … Continue reading How Frugality Made My Life Happier

by Justin @ LivingTheFIghLifeMy wife (a public school teacher) and I (a government employee) both achieved financial independence and retired at the age of 52, or 15 years before Social Security’s full retirement age. Coming when we are still able-bodied and relatively healthy, that 15 years represents a lot of time to follow our curiosities. [This article was … Continue reading How Frugality Made My Life Happier - A Hidden Gem: Ely, UK

by Justin @ LivingTheFIghLifeThe quaint city of Ely in the county of Cambridgeshire, United Kingdom is far enough off the beaten path and such a lovely place worth visiting that I would like to share it with you.

by Justin @ LivingTheFIghLifeThe quaint city of Ely in the county of Cambridgeshire, United Kingdom is far enough off the beaten path and such a lovely place worth visiting that I would like to share it with you. - Can You Buy Back Your Time?

by Justin @ LivingTheFIghLife“I hate cleaning!” “I wish I didn’t have to spend my precious time off mowing the lawn.” “I don’t have time to cook, let’s eat out again” These are common refrains to justify spending money to outsource our daily chores in an effort to protect a few hours of down time. But can we truly … Continue reading Can You Buy Back Your Time?

by Justin @ LivingTheFIghLife“I hate cleaning!” “I wish I didn’t have to spend my precious time off mowing the lawn.” “I don’t have time to cook, let’s eat out again” These are common refrains to justify spending money to outsource our daily chores in an effort to protect a few hours of down time. But can we truly … Continue reading Can You Buy Back Your Time? - Guarding The Gate: How I Stay a Minimalist

by Justin @ LivingTheFIghLifeBecoming a minimalist takes a lot of introspection. Identifying what you value the very most and letting go of the rest is hard work. Asking yourself tough questions to separate the objects you own from the emotions, marketing pressures, perceived value, and other forces that drive what we buy and own. Likewise, I’ve found that … Continue reading Guarding The Gate: How I Stay a Minimalist

by Justin @ LivingTheFIghLifeBecoming a minimalist takes a lot of introspection. Identifying what you value the very most and letting go of the rest is hard work. Asking yourself tough questions to separate the objects you own from the emotions, marketing pressures, perceived value, and other forces that drive what we buy and own. Likewise, I’ve found that … Continue reading Guarding The Gate: How I Stay a Minimalist - Understanding Your Personal Inflation Rate

by Justin @ LivingTheFIghLifeThinking about inflation? Me, too. With recent increases in government tariffs on foreign goods, the specter of higher inflation has increased, and the potential impact on your expenses may be a worry. But the impacts of inflation are not always bad—or as bad as we may think. Inflation is demonized because we tend to notice … Continue reading Understanding Your Personal Inflation Rate

by Justin @ LivingTheFIghLifeThinking about inflation? Me, too. With recent increases in government tariffs on foreign goods, the specter of higher inflation has increased, and the potential impact on your expenses may be a worry. But the impacts of inflation are not always bad—or as bad as we may think. Inflation is demonized because we tend to notice … Continue reading Understanding Your Personal Inflation Rate - Six Myths of Financial Independence and Early Retirement

by Justin @ LivingTheFIghLifeSince my early retirement in 2020, I have noticed several misunderstandings about pursuing financial independence (FI) and retiring early that are frequently perpetuated by FI content creators and their guests. Here are six common myths regarding pursuing full FI and early retirement. While some of these might be true for some individuals or in very … Continue reading Six Myths of Financial Independence and Early Retirement

by Justin @ LivingTheFIghLifeSince my early retirement in 2020, I have noticed several misunderstandings about pursuing financial independence (FI) and retiring early that are frequently perpetuated by FI content creators and their guests. Here are six common myths regarding pursuing full FI and early retirement. While some of these might be true for some individuals or in very … Continue reading Six Myths of Financial Independence and Early Retirement - Tips for Hiking the Lycian Way Inn-to-Inn

by Justin @ LivingTheFIghLifeLauna and I just completed hiking 243 miles (per her Fitbit) over 26 days along the Lycian Way (Likya Yolu in Turkish). Four of those days were “adventure” days where we visited ancient ruins and other sites. This is on top of hiking 100 miles from Bologna to Florence along the Via Degli Dei the … Continue reading Tips for Hiking the Lycian Way Inn-to-Inn

by Justin @ LivingTheFIghLifeLauna and I just completed hiking 243 miles (per her Fitbit) over 26 days along the Lycian Way (Likya Yolu in Turkish). Four of those days were “adventure” days where we visited ancient ruins and other sites. This is on top of hiking 100 miles from Bologna to Florence along the Via Degli Dei the … Continue reading Tips for Hiking the Lycian Way Inn-to-Inn - A Detailed Guide To DIY Scanning Your Old Photos

by Justin @ LivingTheFIghLifeSo, you have a lot of old photos scattered in boxes and old albums in your basement and attic. If you agree with my case to scan your old photos yourself and you decided to skip an overpriced photo scanning service and help cash in on your memory dividends this article is for you. You’ve … Continue reading A Detailed Guide To DIY Scanning Your Old Photos

by Justin @ LivingTheFIghLifeSo, you have a lot of old photos scattered in boxes and old albums in your basement and attic. If you agree with my case to scan your old photos yourself and you decided to skip an overpriced photo scanning service and help cash in on your memory dividends this article is for you. You’ve … Continue reading A Detailed Guide To DIY Scanning Your Old Photos - The Case For Scanning Your Old Photos Yourself

by Justin @ LivingTheFIghLifeMy wife and I bought a $600 high-quality photo scanner and spent the time to cull, organize, and scan our 10,000 or so pre-digital hard copy photos. We are so glad we did! Now, they are a seamless part of our digital photo collection. Our pictures are always with us and we can easily search … Continue reading The Case For Scanning Your Old Photos Yourself

by Justin @ LivingTheFIghLifeMy wife and I bought a $600 high-quality photo scanner and spent the time to cull, organize, and scan our 10,000 or so pre-digital hard copy photos. We are so glad we did! Now, they are a seamless part of our digital photo collection. Our pictures are always with us and we can easily search … Continue reading The Case For Scanning Your Old Photos Yourself - Cashing In On Memory Dividends

by Justin @ LivingTheFIghLifeMy wife and I are celebrating our 35th wedding anniversary this year (and 38 years of being a couple). While on a public ferry in Luxor, Egypt we quizzed each other on the many other ferry boats we had ridden together. We each remembered examples the other hadn’t. It was a fun walk down memory … Continue reading Cashing In On Memory Dividends

by Justin @ LivingTheFIghLifeMy wife and I are celebrating our 35th wedding anniversary this year (and 38 years of being a couple). While on a public ferry in Luxor, Egypt we quizzed each other on the many other ferry boats we had ridden together. We each remembered examples the other hadn’t. It was a fun walk down memory … Continue reading Cashing In On Memory Dividends - Self-Insurance: The Second Important Job For My Emergency Fund

by Justin @ LivingTheFIghLifeHaving an emergency fund is foundational to healthy finances and our pursuit of financial independence. From an unexpected car repair to the loss of a job, the primary job of an emergency fund is to help you weather unexpected financial challenges that could derail your financial progress. Depending on your situation, you may have anywhere … Continue reading Self-Insurance: The Second Important Job For My Emergency Fund

by Justin @ LivingTheFIghLifeHaving an emergency fund is foundational to healthy finances and our pursuit of financial independence. From an unexpected car repair to the loss of a job, the primary job of an emergency fund is to help you weather unexpected financial challenges that could derail your financial progress. Depending on your situation, you may have anywhere … Continue reading Self-Insurance: The Second Important Job For My Emergency Fund - Our Adventures Visiting Schools Around The World

by Justin @ LivingTheFIghLifeMy wife Launa has a new guest blog series at Reading Rockets about how children from different countries are taught to read. As we travel around the world, she and I are having a great time visiting local schools and talking to teachers about how children in their country learn to read. To be clear, … Continue reading Our Adventures Visiting Schools Around The World

by Justin @ LivingTheFIghLifeMy wife Launa has a new guest blog series at Reading Rockets about how children from different countries are taught to read. As we travel around the world, she and I are having a great time visiting local schools and talking to teachers about how children in their country learn to read. To be clear, … Continue reading Our Adventures Visiting Schools Around The World - The More of Minimalism

by Justin @ LivingTheFIghLifeMinimalism has had a profoundly positive impact on my life. I’m healthier and calmer, I have more time and flexibility with money, and I’m more content overall. In an effort to share why I have chosen a minimalist life and why it is so rewarding to me, here are my eight benefits of being a … Continue reading The More of Minimalism

by Justin @ LivingTheFIghLifeMinimalism has had a profoundly positive impact on my life. I’m healthier and calmer, I have more time and flexibility with money, and I’m more content overall. In an effort to share why I have chosen a minimalist life and why it is so rewarding to me, here are my eight benefits of being a … Continue reading The More of Minimalism - Minimalism Changed Who I Am.

by Justin @ LivingTheFIghLifeI used to be a cyclist, gardener, canner, aspiring musician, soccer coach, coin collector, stamp collector, home owner, DIY handyman, and Department of Defense hospitality expert. I am no longer those things. I found that by selling, giving away, or otherwise disposing of my guitars, soccer gear, biking gear, coin and stamp collections, work files, … Continue reading Minimalism Changed Who I Am.

by Justin @ LivingTheFIghLifeI used to be a cyclist, gardener, canner, aspiring musician, soccer coach, coin collector, stamp collector, home owner, DIY handyman, and Department of Defense hospitality expert. I am no longer those things. I found that by selling, giving away, or otherwise disposing of my guitars, soccer gear, biking gear, coin and stamp collections, work files, … Continue reading Minimalism Changed Who I Am. - Ask Yourself Tough Questions And Let The Answers Change You

by Justin @ LivingTheFIghLife[This was first published on the minimalism and lifestyle blog No Sidebar.] My wife and I sold or gave away 98 percent of our belongings which enabled us to achieve our goal to become full-time nomadic travelers in July 2023. In my pursuit of a simpler life with fewer things, I had to ask myself … Continue reading Ask Yourself Tough Questions And Let The Answers Change You

by Justin @ LivingTheFIghLife[This was first published on the minimalism and lifestyle blog No Sidebar.] My wife and I sold or gave away 98 percent of our belongings which enabled us to achieve our goal to become full-time nomadic travelers in July 2023. In my pursuit of a simpler life with fewer things, I had to ask myself … Continue reading Ask Yourself Tough Questions And Let The Answers Change You - Decluttering My Mind: Eliminating conversations with my stuff

by Justin @ LivingTheFIghLifeBefore I embraced minimalism, I loved to go camping. In the woods I noticed how quiet my mind was. It wasn’t just bathing in the trees that was calming. I enjoyed not being reminded by my multitude of belongings of the many chores I needed to get done at home. Similarly, when I was in … Continue reading Decluttering My Mind: Eliminating conversations with my stuff

by Justin @ LivingTheFIghLifeBefore I embraced minimalism, I loved to go camping. In the woods I noticed how quiet my mind was. It wasn’t just bathing in the trees that was calming. I enjoyed not being reminded by my multitude of belongings of the many chores I needed to get done at home. Similarly, when I was in … Continue reading Decluttering My Mind: Eliminating conversations with my stuff - Five Things Minimalism Is Not

by Justin @ LivingTheFIghLifeMinimalism changed my life for the better. Minimalism at its core is focusing on what we truly value and eliminating the rest. There is not a definitive number of things a person should own to be a minimalist, and making minimalism a comparison game defeats one of its key purposes. While the concept has grown … Continue reading Five Things Minimalism Is Not

by Justin @ LivingTheFIghLifeMinimalism changed my life for the better. Minimalism at its core is focusing on what we truly value and eliminating the rest. There is not a definitive number of things a person should own to be a minimalist, and making minimalism a comparison game defeats one of its key purposes. While the concept has grown … Continue reading Five Things Minimalism Is Not - The Metamorphosis to Becoming a Minimalist

by Justin @ LivingTheFIghLifeMy wife and I sold or gave away 98 percent of our belongings. Our dream to be full-time nomadic travelers took flight in July 2023––a goal we never thought possible until we fully embraced minimalism. In her popular book The Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and Organizing Marie Kondo is … Continue reading The Metamorphosis to Becoming a Minimalist

by Justin @ LivingTheFIghLifeMy wife and I sold or gave away 98 percent of our belongings. Our dream to be full-time nomadic travelers took flight in July 2023––a goal we never thought possible until we fully embraced minimalism. In her popular book The Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and Organizing Marie Kondo is … Continue reading The Metamorphosis to Becoming a Minimalist - Why You Should Quit Your Dream Job

by Justin @ LivingTheFIghLifeI frequently hear on Financial Independence and Retire Early (FIRE) podcasts and read in FIRE blogs that the RE (Retire Early) part of the FIRE acronym should be dropped. They can’t imagine not working, they say, and besides, they enjoy working. I know what they mean. I had my dream job, and I worked it … Continue reading Why You Should Quit Your Dream Job

by Justin @ LivingTheFIghLifeI frequently hear on Financial Independence and Retire Early (FIRE) podcasts and read in FIRE blogs that the RE (Retire Early) part of the FIRE acronym should be dropped. They can’t imagine not working, they say, and besides, they enjoy working. I know what they mean. I had my dream job, and I worked it … Continue reading Why You Should Quit Your Dream Job - Rent vs. Buy: the Power of Inflation (and a fairer calculation)

by Justin @ LivingTheFIghLife(Originally published Feb 1, 2023. Revised—substantial edits in italics) The FIRE community talks a lot about the rent vs. buy discussion. Which is the optimal financial decision for your personal housing and how to calculate that? While there is great information out there to help you decide, I see two important considerations often left out … Continue reading Rent vs. Buy: the Power of Inflation (and a fairer calculation)

by Justin @ LivingTheFIghLife(Originally published Feb 1, 2023. Revised—substantial edits in italics) The FIRE community talks a lot about the rent vs. buy discussion. Which is the optimal financial decision for your personal housing and how to calculate that? While there is great information out there to help you decide, I see two important considerations often left out … Continue reading Rent vs. Buy: the Power of Inflation (and a fairer calculation) - Real Estate is Passive or I Make $2,800 Per Hour

by Justin @ LivingTheFIghLifeWhat? $2,800 per hour? This must be a crazy MLM scheme or some sort of bait and switch scam, right? Not at all. On average I work one hour a month managing my two real estate properties. Each month I clear an average of $2,816 (including my principal and net of expenses and taxes). So … Continue reading Real Estate is Passive or I Make $2,800 Per Hour

by Justin @ LivingTheFIghLifeWhat? $2,800 per hour? This must be a crazy MLM scheme or some sort of bait and switch scam, right? Not at all. On average I work one hour a month managing my two real estate properties. Each month I clear an average of $2,816 (including my principal and net of expenses and taxes). So … Continue reading Real Estate is Passive or I Make $2,800 Per Hour - Business Insider: Meet the millionaires next door who grew their wealth without a superstar job or get-rich-quick tricks

by Justin @ LivingTheFIghLifeI’m featured in this article by Noah Sheidlower, Business Insider, Sep 1, 2024 “Not all millionaires have big houses, boats, or fancy cars. In fact, six of them told BI their strategies to grow wealth — and keep it — are the exact opposite. ‘We aren’t flashy with our wealth because money isn’t our ultimate goal,’ … Continue reading Business Insider: Meet the millionaires next door who grew their wealth without a superstar job or get-rich-quick tricks

by Justin @ LivingTheFIghLifeI’m featured in this article by Noah Sheidlower, Business Insider, Sep 1, 2024 “Not all millionaires have big houses, boats, or fancy cars. In fact, six of them told BI their strategies to grow wealth — and keep it — are the exact opposite. ‘We aren’t flashy with our wealth because money isn’t our ultimate goal,’ … Continue reading Business Insider: Meet the millionaires next door who grew their wealth without a superstar job or get-rich-quick tricks - My FI Story and Why FI Needs the RE

by Justin @ LivingTheFIghLifeI was recently interviewed on the EverydayFI podcast where I shared my FI story, how I fully embraced minimalism, became a full-time nomad, and some philosophy on the FI movement and choosing contentment over happiness. Cheers! Link to episode: https://podcasts.apple.com/us/podcast/everydayfi/id1747124575 To learn more about my story check out my About page and my Taking the … Continue reading My FI Story and Why FI Needs the RE

by Justin @ LivingTheFIghLifeI was recently interviewed on the EverydayFI podcast where I shared my FI story, how I fully embraced minimalism, became a full-time nomad, and some philosophy on the FI movement and choosing contentment over happiness. Cheers! Link to episode: https://podcasts.apple.com/us/podcast/everydayfi/id1747124575 To learn more about my story check out my About page and my Taking the … Continue reading My FI Story and Why FI Needs the RE - The Pursuit of Contentment

by Justin @ LivingTheFIghLife“I want to be happy” was how I replied when asked as a youth what I wanted to be in life. Likely inspired by our country’s Declaration of Independence, I bought into the enticing desire of achieving full happiness. It doesn’t work that way. In the pursuit of a life of bliss, I read several books … Continue reading The Pursuit of Contentment

by Justin @ LivingTheFIghLife“I want to be happy” was how I replied when asked as a youth what I wanted to be in life. Likely inspired by our country’s Declaration of Independence, I bought into the enticing desire of achieving full happiness. It doesn’t work that way. In the pursuit of a life of bliss, I read several books … Continue reading The Pursuit of Contentment - FI Needs the RE!

by Justin @ LivingTheFIghLifeThe (ability to) retire early part is the primary thing that makes the Financial Independence Retire Early (FIRE) community different from all the other personal finance approaches. We CAN retire early, and we as a community should own it. The following chart illustrates how FIRE principles compare to that of other, non-FIRE personal finance voices: … Continue reading FI Needs the RE!

by Justin @ LivingTheFIghLifeThe (ability to) retire early part is the primary thing that makes the Financial Independence Retire Early (FIRE) community different from all the other personal finance approaches. We CAN retire early, and we as a community should own it. The following chart illustrates how FIRE principles compare to that of other, non-FIRE personal finance voices: … Continue reading FI Needs the RE! - Frugality Increases Happiness

by Justin @ LivingTheFIghLifeAnd as a corollary, frugality does not mean deprivation, suffering, or unhappiness. Spending more does not equal more happiness just as spending less does not equal less happiness. While frugality is core to how we achieve FIRE, it does not have to mean a life of deprivation. The FIRE community is too creative for that. [This … Continue reading Frugality Increases Happiness

by Justin @ LivingTheFIghLifeAnd as a corollary, frugality does not mean deprivation, suffering, or unhappiness. Spending more does not equal more happiness just as spending less does not equal less happiness. While frugality is core to how we achieve FIRE, it does not have to mean a life of deprivation. The FIRE community is too creative for that. [This … Continue reading Frugality Increases Happiness - Is The Stock Market Becoming a Ponzi Scheme?

by Justin @ LivingTheFIghLifeThe convergence of the widespread use of 401k and similar retirement accounts coupled with the rise in index fund investing has created a Ponzi scheme-like dynamic with the stock market over the past 30+ years.. What is a Ponzi scheme? From Wikipedia, a Ponzi scheme “is a form of fraud that lures investors and pays … Continue reading Is The Stock Market Becoming a Ponzi Scheme?

by Justin @ LivingTheFIghLifeThe convergence of the widespread use of 401k and similar retirement accounts coupled with the rise in index fund investing has created a Ponzi scheme-like dynamic with the stock market over the past 30+ years.. What is a Ponzi scheme? From Wikipedia, a Ponzi scheme “is a form of fraud that lures investors and pays … Continue reading Is The Stock Market Becoming a Ponzi Scheme? - My Top 10 Accounting Principles for Everyday Life

by Justin @ LivingTheFIghLifeAccounting helps businesses track and organize financial information so business leaders can make informed decisions. Similarly in personal finance we all implement some level of accounting to help manage our finances to track, budget, spend, save, invest and file taxes. In a past life I managed multi-million dollar businesses with complex financial statements and taught … Continue reading My Top 10 Accounting Principles for Everyday Life

by Justin @ LivingTheFIghLifeAccounting helps businesses track and organize financial information so business leaders can make informed decisions. Similarly in personal finance we all implement some level of accounting to help manage our finances to track, budget, spend, save, invest and file taxes. In a past life I managed multi-million dollar businesses with complex financial statements and taught … Continue reading My Top 10 Accounting Principles for Everyday Life - Has the FIRE movement lost its way?

by Justin @ LivingTheFIghLifeIn a recent episode of ChooseFI podcast (a favorite of mine), a visiting host (Katie, from MoneyWithKatie.com) talked about buying “a very nice car [a pre-owned Porsche Macan with 8,000 miles].” She was quick to acknowledge that this decision was “breaking the cardinal sin of FI/RE” but the main ChooseFI host, Brad, quickly said that … Continue reading Has the FIRE movement lost its way?

by Justin @ LivingTheFIghLifeIn a recent episode of ChooseFI podcast (a favorite of mine), a visiting host (Katie, from MoneyWithKatie.com) talked about buying “a very nice car [a pre-owned Porsche Macan with 8,000 miles].” She was quick to acknowledge that this decision was “breaking the cardinal sin of FI/RE” but the main ChooseFI host, Brad, quickly said that … Continue reading Has the FIRE movement lost its way? - Home Exchanging: A Great Way to See the World

by Justin @ LivingTheFIghLifeSince 2013, we have exchanged our Arlington, VA home 10 times (excluding several planned exchanges foiled by the pandemic). We exchanged with families in Paris, Barcelona, Montreal, and Iceland, to name a few. With the world opening back up, this is a good time to share what is great about a home exchange experience. What … Continue reading Home Exchanging: A Great Way to See the World

by Justin @ LivingTheFIghLifeSince 2013, we have exchanged our Arlington, VA home 10 times (excluding several planned exchanges foiled by the pandemic). We exchanged with families in Paris, Barcelona, Montreal, and Iceland, to name a few. With the world opening back up, this is a good time to share what is great about a home exchange experience. What … Continue reading Home Exchanging: A Great Way to See the World - Calculating Functional Net Worth

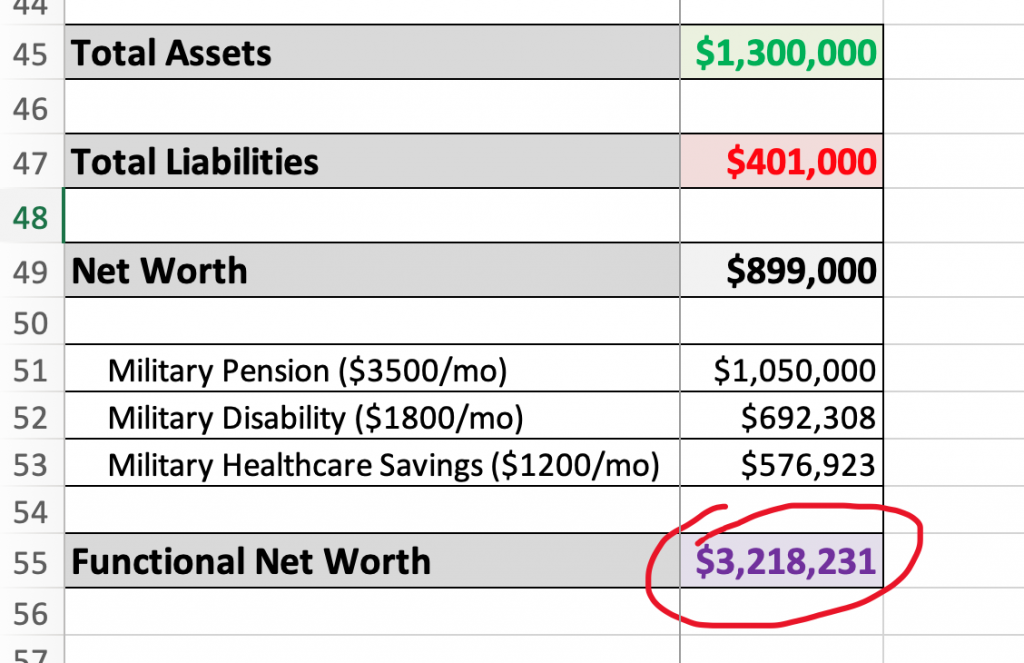

by Justin @ LivingTheFIghLifeNet worth is a key measure of building wealth. I have been calculating my net worth since 2011 so I can see my progress over time, and it’s a really useful tool. Many people are familiar with calculating their net worth: you add up the value of all of your assets (e.g., stocks, bonds, real … Continue reading Calculating Functional Net Worth

by Justin @ LivingTheFIghLifeNet worth is a key measure of building wealth. I have been calculating my net worth since 2011 so I can see my progress over time, and it’s a really useful tool. Many people are familiar with calculating their net worth: you add up the value of all of your assets (e.g., stocks, bonds, real … Continue reading Calculating Functional Net Worth - What It Means To Be A “Millionaire”

by Justin @ LivingTheFIghLifeWhen host Regis Philbin asked his game show contestants and audience “who wants to be a millionaire?,” he tapped into a belief many of us learned as children, that a million dollars was the pinnacle of financial success. I grew up on the rural eastern side of Washington State, and many people I knew were … Continue reading What It Means To Be A “Millionaire”

by Justin @ LivingTheFIghLifeWhen host Regis Philbin asked his game show contestants and audience “who wants to be a millionaire?,” he tapped into a belief many of us learned as children, that a million dollars was the pinnacle of financial success. I grew up on the rural eastern side of Washington State, and many people I knew were … Continue reading What It Means To Be A “Millionaire” - Taking the Leap of Early Retirement — Living The FIgh Life

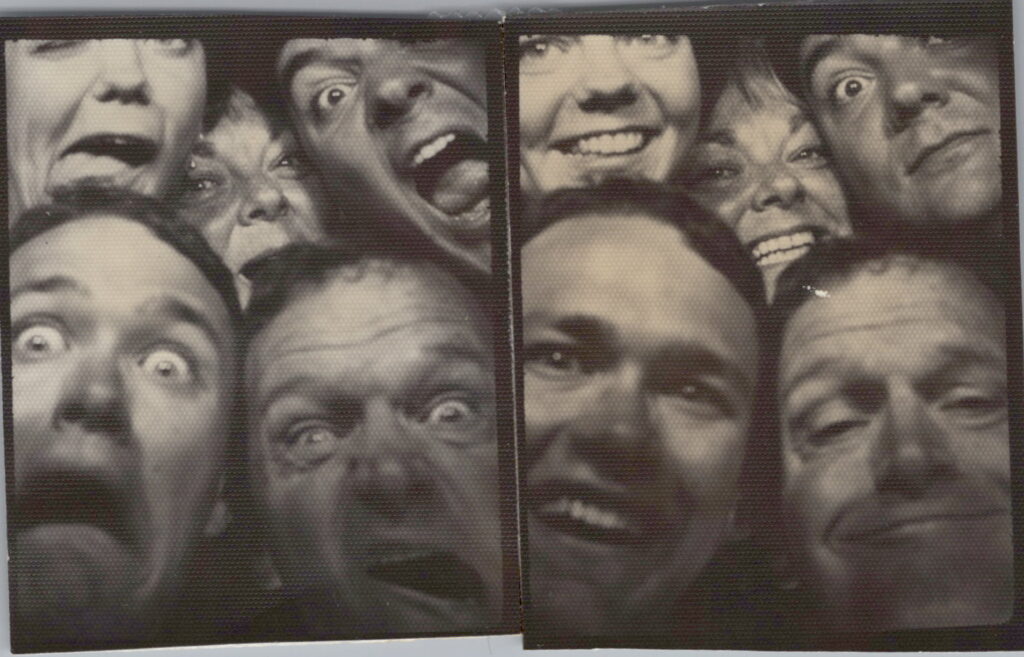

by Justin @ LivingTheFIghLifeOn August 28, 2020 at 5:47 pm, at age 52, I declared my financial independence (FI), packed up my personal belongings and left my GS-15 job at the Department of Defense after 9 years of civil service and 20 years of active duty. How was I feeling? As you can see from the below video, … Continue reading Taking the Leap of Early Retirement — Living The FIgh Life

by Justin @ LivingTheFIghLifeOn August 28, 2020 at 5:47 pm, at age 52, I declared my financial independence (FI), packed up my personal belongings and left my GS-15 job at the Department of Defense after 9 years of civil service and 20 years of active duty. How was I feeling? As you can see from the below video, … Continue reading Taking the Leap of Early Retirement — Living The FIgh Life - Why We Declined the Survivor Benefit Plan and Are Richer For It.

by Justin @ LivingTheFIghLifeI often hear (and read) discussions about choosing either the military Survivor Benefit Plan (SBP) or term life insurance to ensure the surviving spouse remains financially secure. This is comparing the wrong two things! (And any comparison of either with permanent (aka “whole”) life insurance is way off course.) While both term life insurance and … Continue reading Why We Declined the Survivor Benefit Plan and Are Richer For It.

by Justin @ LivingTheFIghLifeI often hear (and read) discussions about choosing either the military Survivor Benefit Plan (SBP) or term life insurance to ensure the surviving spouse remains financially secure. This is comparing the wrong two things! (And any comparison of either with permanent (aka “whole”) life insurance is way off course.) While both term life insurance and … Continue reading Why We Declined the Survivor Benefit Plan and Are Richer For It. - After Almost Two Decades of Investing, Why Weren’t We Rich or at Least Well on Our Way?

by Justin @ LivingTheFIghLifeI thought my wife and I were doing everything right to achieve a rich, free life. Avoid debt – check! Spend less than we earn – check! Invest the surplus – check! So, after almost two decades of investing, why weren’t we rich or at least well on our way? When I calculated our net … Continue reading After Almost Two Decades of Investing, Why Weren’t We Rich or at Least Well on Our Way?

by Justin @ LivingTheFIghLifeI thought my wife and I were doing everything right to achieve a rich, free life. Avoid debt – check! Spend less than we earn – check! Invest the surplus – check! So, after almost two decades of investing, why weren’t we rich or at least well on our way? When I calculated our net … Continue reading After Almost Two Decades of Investing, Why Weren’t We Rich or at Least Well on Our Way?

Sign-up to get notifications of new posts and updates: