I avoid writing about the many places we enjoy as full-time nomads, not because they are not interesting, but because there is already so much being written about popular places to visit. I try to focus my posts on topics that are different from the norm, usually personal finance and minimalism, but today it is a place to visit. The quaint city of Ely in the county of Cambridgeshire, United Kingdom is far enough off the beaten path and such a lovely place worth visiting that I would like to share it with you.

Launa and I were lucky enough to live in Ely for two and a half years in the mid-nineties when we were stationed at nearby US military bases. We fell in love with Ely. We returned this month, over 28 years later, for a relaxing 3-day visit, and we were reminded why this is such a great place.

We took the hour-long train ride from London’s King’s Cross station and stayed on the River Great Ouse at the Riverside Inn. (In the nineties, this was a pub called the Boathouse which served delicious pan-fried lamb chops with mint sauce.) On this visit, we accidentally chose the busiest weekend of the year with both the folk festival and home and garden show going on, but even so, it wasn’t overrun.

If you are like me and look for remarkable sites with a lot of local culture while avoiding major crowds, then Ely is your place. Here are my main reasons why you should consider a 2-3 day visit to Ely as part of your UK holiday.

The Ely Cathedral

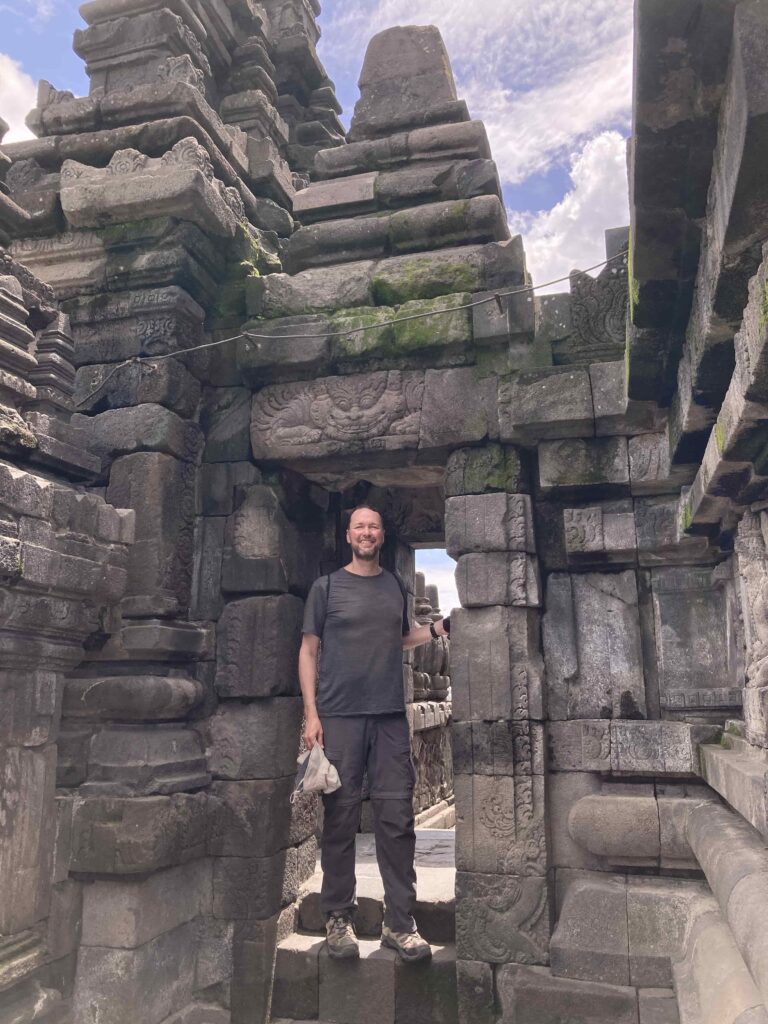

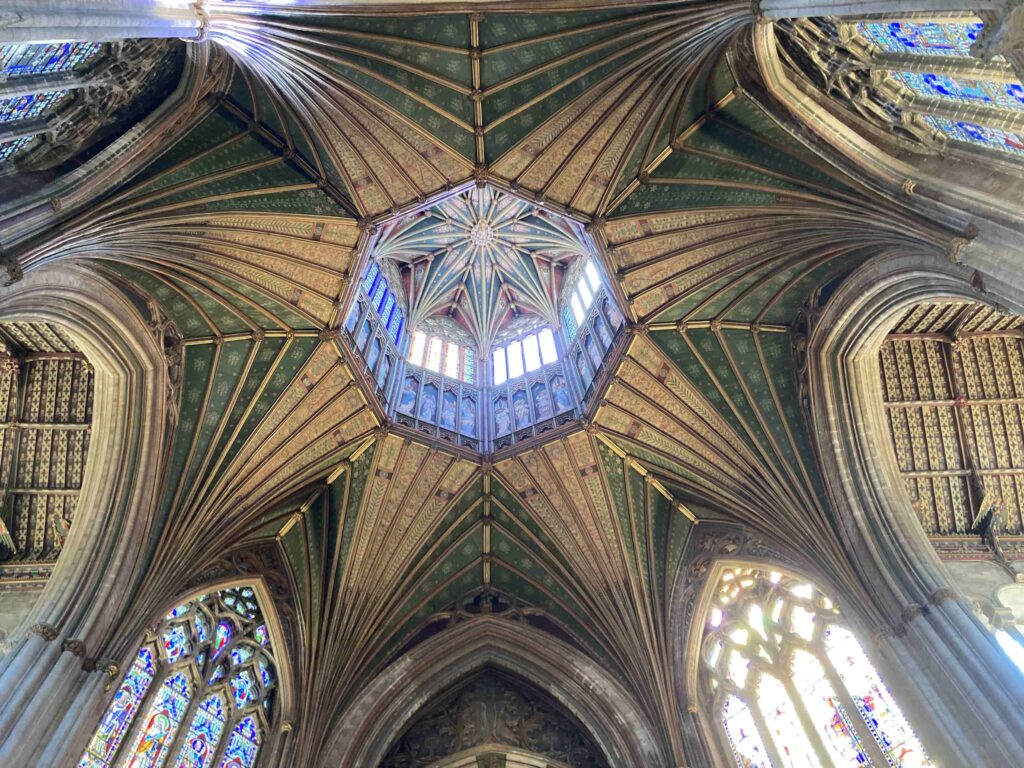

I know. You are probably thinking “not another church that looks like all the others.” After innumerable churches and cathedrals visited, I also find myself reluctant to visit a place primarily because of a church. But the Ely Cathedral is not just any church, or any cathedral for that matter. It is a unique gem.

The Ely Cathedral was built in 1109 AD on the top of the Isle of Ely, the highest point in the East Anglican fens. While it is not the largest, longest, or tallest cathedral in the UK, it ranks high on all measures. But what sets Ely apart is its octagon tower which can be seen for 20 miles on a clear day or night (it is illuminated at night). This engineering marvel was built in the 15th century to replace a fallen Norman tower. The builders removed the old interior supports and transferred weight of the new octagon lantern-shaped tower to the outside supports, creating a much larger interior opening and a gravity-defying, spectacular tower above. The cathedral boasts the largest Lady Chapel in the UK, the third longest nave, and some of the best preserved carved choir stalls in the country. Due to its location at the highest point in the surrounding fen lands and the small city surrounding it, the building can be easily seen from near and far. Be sure to take a guided tour of the main church AND take a tour of the Octagon tower where you go up into the structure and see the eight massive (60+ ft) wooden pillars of the main octagon, and the supporting beams that shift the weight to the outside supports.

Left: The octagon tower from the outside. The lady chapel is on the left. Right: Inside below the octagon tower (my camera didn’t do it justice!).

Other Worthwhile Tourist Sites

Oliver Cromwell’s Family Home: After enjoying the cathedral, visit the Oliver Cromwell House nearby where the controversial Lord Protector once lived. The kitchen dates to 1205 and the home has been restored to look as it did during Cromwell’s life. It provides a history of the civil war and Cromwell’s time leading the commonwealth.

Ely Museum: A perfectly sized museum in the old city jail that details the history of the fens and Ely. I enjoyed learning about how the fens were drained using Dutch engineering, much as they did in the Netherlands.

Stained Glass Museum: Located inside the Ely Cathedral, this worthwhile museum displays an array of historical and contemporary stained glass from around the UK and a few pieces beyond. I was amazed to find a Kahinde Wiley piece on display (I had recently admired his work at the Virginia Museum of Art in Richmond, VA and at the Seattle Art Museum).

Left: Peasant figure (c. 1340-1349) from the Ely Lady Chapel. It is rare to have a peasant in stained glass, but likely why it survived the destruction of religious iconography during the Reformation. Right Image: Kehinde Wiley’s “Saint Adelaide” (2014). Wiley designed the work and had it made by the Skloart glass studio in the Czech Republic.

Local Culture

Ely’s culture scene hits above its weight class. It boasts a thrice weekly market, several fairs and events during the year, and runs the local Ely cinema in the historical Maltings building on the river front (where we took in a movie with a pint in hand). The high street is pedestrian-only during market days and the city has numerous restaurants and pubs to enjoy a delicious bite. I recommend the Almonry Restaurant and Tea Room located in a 13th century undercroft with a lovely terrace.

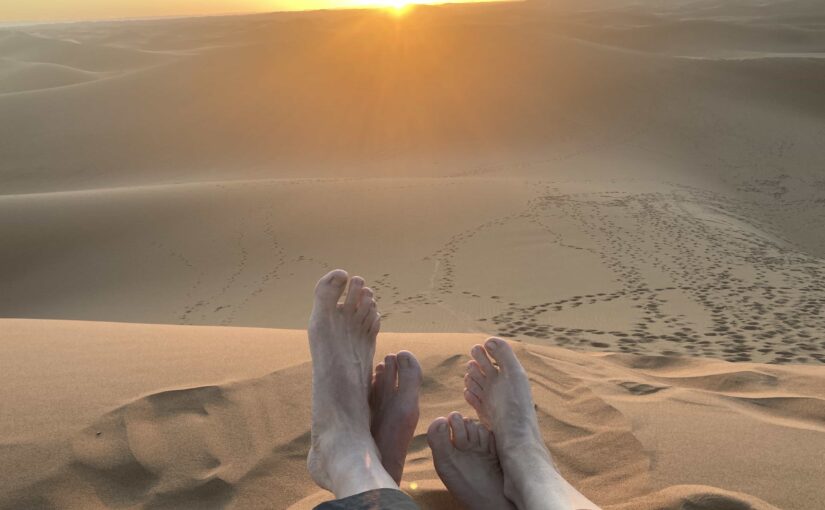

The city center is connected to the waterfront by a park corridor with a walking path from the Porta gate along the cathedral walls, through Cherry Hill Park and Jubilee Gardens. The Ely riverside boasts several restaurants and pubs—we enjoyed a pint (or two) at the Cutter Inn. Enjoy a stroll along the waterfront admiring the narrowboats, swans, and geese. We walked the public pathways along the river to see some of the lush marshes along the canal that is home to numerous bird species. Take a 30-minute tour along the canal in a narrowboat to see the beauty of the willow trees and marsh edges from the water.

Last Photo: View from path between the High Street and the river front

The people of Ely are very kind and open. Everywhere we went we were engaged in great conversations—this was probably the best part of our visit. We enjoyed so many great encounters at the local pub, the cinema, on our nature walk, and around the cathedral.

I’m not an experienced travel writer, but I hope I have sparked your interest in visiting Ely. Even if you want to split your time between Cambridge and Ely, I recommend staying in Ely and taking the 15-minute train into Cambridge for a day trip (Kings College Chapel is worth a visit). In my travels, I have found that famous sites are far less amazing when they are overrun with visitors, while the lesser, but still amazing, sites can be phenomenal when you have them to yourself. Ely has yet to be discovered by the wider world—now is a great time to see it before it makes a popular “best places to visit” list and it is no longer a hidden gem. Cheers!