Launa and I celebrated our second anniversary of nomadic travel this month. It has been an incredible life experience so far with so much more to see and do in the world. After letting go of 98% of our possessions and turning our house into our second rental unit, we embarked on a full-time nomadic life in July of 2023. This anniversary feels like a good moment to take a look at some of our statistics and reflect on all we’ve experienced and what I have learned so far.

[Post cover photo: Our first day traveling full-time, West Virginia, US, July 2023]

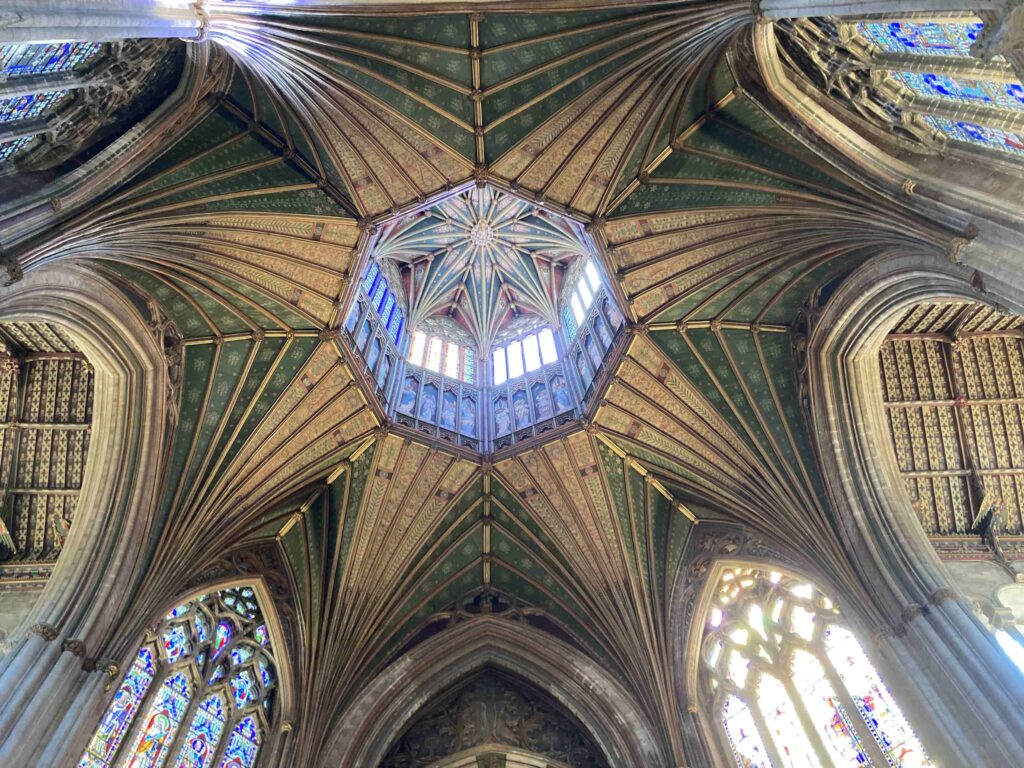

Though we travel slowly most of the time, we have slept in 159 different beds during these two years (31 of those during inn-to-inn hikes on Italy’s Via Degli Dei and Turkiye’s Lycian Way. We have logged over 8 million steps ( about 3150 miles) and, as part of that, hiked over 500 miles. We spent 34% of our travel time in the US visiting family and friends and the remaining 66% visiting other countries. Those countries were Bulgaria, Greece, Morocco, Spain, Mexico, Singapore, Japan, South Korea, Vietnam, Cambodia, Laos, Thailand, Indonesia, Malaysia, Egypt, Italy, Turkiye, and the UK (where we are right now).

Based on my values and how I strive to travel, here are 9 lessons and 1 observation I have learned from traveling full time:

1. Pack whitespace.

While we travel with only a carry-on and a backpack, I have found that whitespace, both physical and temporal, is very important in my traveling. Even though I travel slowly, I still pack and unpack a lot. Not completely filling my two bags to capacity makes the packing/unpacking quick and easy. Having some free space means I don’t have to be overly precise with my packing, and as a result I’m less concerned about what’s in my bags. I don’t have to constantly question the worth of each item I own because space is tight. Everything fits easily and that makes travel days more enjoyable.

I also pack some temporal whitespace for my travels. Minimalism has helped me add space between things, but also time between tasks. I have learned to leave plenty of time for each thing I want to do and extra time in between. In Japan, this concept is called yutori. Yutori translates to “spaciousness” or “room to breathe” and goes beyond just physical space, encompassing mental, emotional, and temporal space as well. The idea is simple: by creating intentional gaps in your schedules (and mind), you allow yourself the freedom to think, create, and recharge. Yutori encourages us to resist the urge to fill every moment with activity and instead embrace periods of stillness. It goes against the modern emphasis on constant productivity and multitasking, offering a different approach that prioritizes well-being. Added time to get to the airport, added time between activities, and giving myself plenty of time to stretch, read, and enjoy a cup of tea (or other refreshing beverage) has been essential to my well-being.

2. Live a traveling life, not an endless vacation.

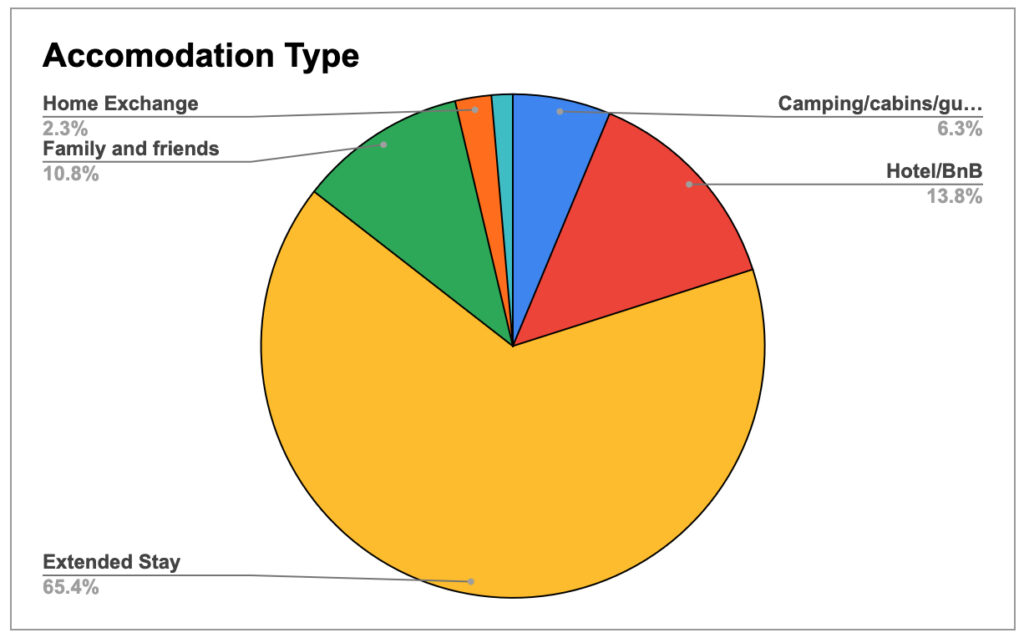

Upon hearing that I travel full-time many people observe “it must be great to always be on vacation.” It is true that on many days my wife and I visit a famous ruin, temple, museum or other touristy spot. However, many days we read, do laundry, shop for groceries, write, plan and book future travel, or just take a walk in the neighborhood we are in. We still need to live our daily lives and we quickly tire when we pick up the touring pace. We have found that staying at least a month in one location (i.e., a single accommodation) is a good target. Between these month-long stays we have spurts of busier travel as we transition from one place to another. Traveling slowly is our secret sauce to avoiding burnout and keeping our travels affordable.

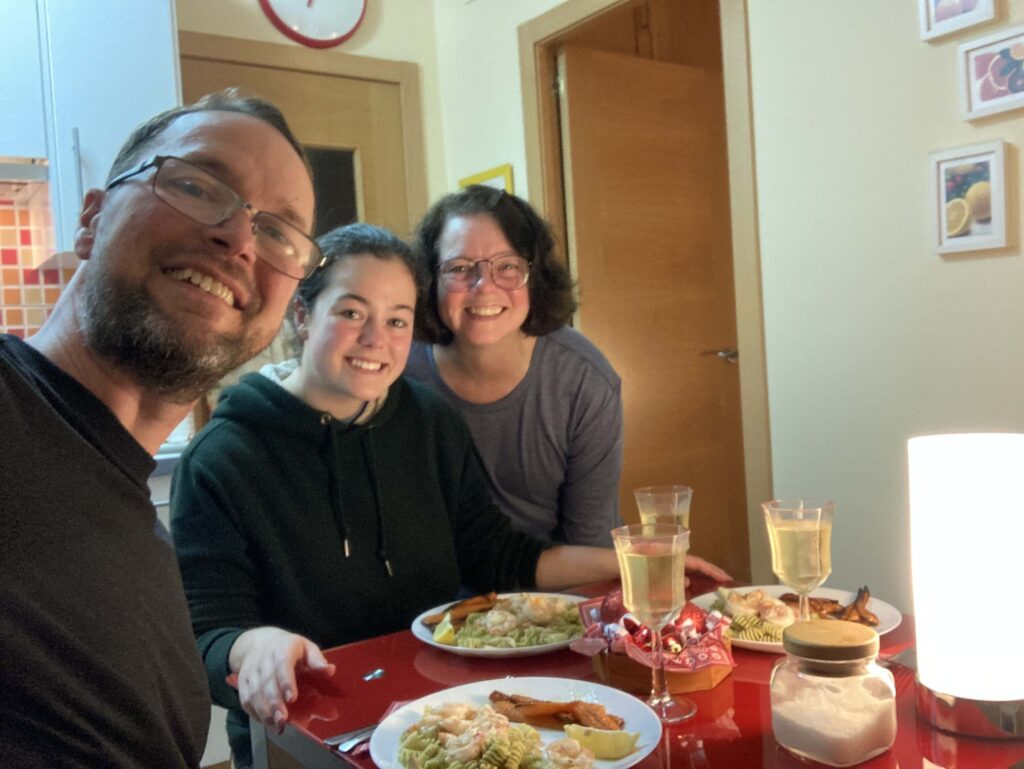

Left/Top: Making homemade pasta with our son and partner. Right/Bottom: Enjoying a homemade Christmas dinner with our daughter (she cooked!) in Sevilla, Spain.

3. Recognize that the faster the travel pace, the more travel planning is required.

It came as a surprise to me, but even though I travel slowly, I spend a good amount of my days researching and booking our upcoming travel and obtaining necessary visas. It takes time to decide where to travel to and even more time to find quality affordable accommodations and transportation. Once we know what we want to book and when, I spend hours actually completing all of the bookings. The more frequently we move places, the more this workload is multiplied. By traveling slowly I have more time to enjoy each destination and my daily life.

4. Limit time spent on the next destination

When I vacationed in my past life, I spent a lot of time planning in advance the sites to see each day at our upcoming vacation spots and brushing up on the local language, history, and culture. I had time at home before the vacation to do this. But as a full-time traveler, I don’t want to spend my time in one country thinking about what I am going to do day-to-day in the next country or learning new language phrases when I am currently using a different language. This degrades my enjoyment of the place I am currently in. Understanding a few things like transportation to the next place, basic accommodations when we arrive, and an occasional show or festival tickets that benefit from advance purchase, I research what to do in a country when I am in that country. Slow traveling enables this as I have extra days built in for planning our explorations. If we learn about a weekly event, we know that we will have several opportunities to enjoy it before we move on. This enables me to more fully enjoy the place I am in and live in the moment and not always be looking toward what’s ahead.

5. Choose less famous and less busy over famous and overrun.

I was disappointed after visiting the famous UNESCO World Heritage site Kinkaku-ji Temple (a.k.a.Golden Pavilion) in Kyoto, Japan. The crowd was an endless line of people jostling for a picture. The stream of tourists were kept on a narrow roped path and could not stray from the set route. We were not allowed to enter any of the buildings at the temple complex and 30 or so minutes after we entered, we were spit back out at the large tour bus parking area. I learned little from the visit and only learned about the history of the temple later, online. I had a similar experience at the super popular Fushimi Inari-taisha shrine that was so crowded that we physically had trouble moving around. In contrast, I visited the far less popular Ninna-Ji Temple (also UNESCO designated) just a short public bus ride away. I felt like I entered old Japan—immersed in a historical and meditative environment. With far fewer crowds, we entered several buildings and lingered in the gardens and courtyards, rang the bells, sat on the benches, listened to unique music recorded there, and took photos easily without other people in the background. I felt immersed and contemplative. Going to less popular destinations (or during less popular seasons) is more rewarding than fighting the crush of crowds.

6. Take public transportation.

Immersing in the local culture is very important to me. Most tourist transportation options (e.g., airplanes, tour buses, private boats, and cruise ships) insulate tourists from the day-to-day lives of the locals and tend only to show a curated perspective on the place being visited. I have found that taking public transportation provides a fabulous (and less expensive) window into the local culture. We sat on the floorboards of a small public boat transporting dozens of locals and a load of cargo from Labuan Bajo to Komodo Island in Indonesia. We learned so much about the pace of life in the small village and the economic dynamics between it and its nearest city. It was invaluable. We have had similar cultural experiences with local buses in Oaxaca, Chania, Hanoi, Sapporo, and Marrakech, the subway in Mexico City, and the trains in Morocco, Italy, and Indonesia. We travel local whenever we can.

7. Trust that people are kind and places are safe.

I have found people around the world to be generous and kind. While we have met an occasional salesperson trying to make an extra buck in a transaction, the vast majority of people we meet go out of their way to welcome us and help us enjoy their beautiful country. Many times we have been offered helpful directions. At a chestnut festival on Crete, we were adopted by an elderly Greek man who explained in broken English what was going on with the stage presentations. In Bulgaria, a grocery store owner gave my wife an orange to welcome her to the neighborhood. There are so many examples of this kind of big heartedness.

When we decided to spend two and a half months in Mexico, many of my relatives expressed their worry for our safety. Unfortunately, the rare crime against a visitor gets way too much publicity. In my experience I found Mexico to feel very safe. I felt safe walking at night in Mexico City, Oaxaca, and several other cities. I felt completely safe riding public buses and subways. In earnest, I have never felt unsafe anywhere I have visited around the world.

8. Stay connected with family and friends.

One of the hardest parts of full-time travel has been keeping up with close friends and family. This is important to me. So while travel is one of my top values, increasing quality time with friends and family is also important. To balance the two, we travel back to the US every 3 to 6 months and spend at least 1 to 2 months making the rounds. We visit our son and partner in Richmond, VA and our close friends in Arlington, VA, then we spend time in the Pacific Northwest visiting our daughter and her boyfriend in Oregon, my mom and sisters in northern Idaho, and Launa’s family on the Olympic peninsula while fitting in some visits with old friends in the area. I was so heartened when my mom expressed how great it was to see us so much more compared to when we worked full time—success!

When we are on the road, we schedule weekly calls with my mom, Launa’s parents, and our two children and periodic calls with other relatives and some of our closest friends. We fund our kids to come visit us on the road at least once a year, and we have met up with friends in Vietnam, Oaxaca, and Mexico City. All of this has helped us maintain our close relationships.

I know many people who are single and travel full-time solo. Some are extroverts and easily meet friends on the road, while others are introverts and more easily enjoy time alone. Though I am an introvert, I don’t like to be alone for long stretches of time. I need to be around close friends and family. A key part of my traveling success has been having my closest friend of almost 38 years with me—Launa. Traveling full-time with someone requires spending A LOT of time together. Fortunately, our interests and traveling styles overlap and compliment each other. This made our decision to travel full-time much easier and a key reason why we are still enjoying this life. We definitely need our alone time which we carve out during our travels, but for me, having my best friend share this adventure has been the core to making this traveling life not only work, but become some of the happiest times of my life.

9. Keep a routine.

Getting quality sleep, stretching, and exercising every day as well as eating a vegetarian diet are just a few things I have found challenging to maintain on the road. (Although to be fair, I found it challenging to fit these in when I was working full-time, too!). Each location offers challenges to maintaining my daily routine. Travel days and time zone shifts, as well as occasionally getting up early to visit a popular site before the hordes descend upon it, often throw off my sleep and daily routine. Digestive difficulties are my frequent companions as my diet changes from place to place. By traveling slowly, though, I am able to reestablish my routines, work out, and seek out healthier (e.g., vegetarian) food options. This consistency has been key to maintaining my mental and physical well-being.

…And 1 observation: It’s Less Expensive Than Many People Think

When people in the US hear that we travel the world full-time, they often mention how expensive it must be. The US is one of the most expensive places to live and travel to in the world. In my experience, lodging, food, and transportation in the US have been far more expensive than every place we have visited so far including Japan, South Korea, Singapore, Greece, Italy and the UK. It isn’t even close. Even with airfare to different countries added in, we spend on average less each month than when we were living a happy frugal life in a suburb of DC. Most places don’t expect tips and already include taxes in their prices. We don’t travel like “2-week millionaires”—spending an inordinate sum in a short period to maximize limited vacation time. Travel is a lot more expensive when trying to pack in a whole country (or many countries) in just a few days. Transportation costs a lot more (e.g., if there’s no time to wait for a bus, you pay 20 times more for an Uber), as does eating out more (instead of cooking in), paying peak prices for summer and holiday period travel, and higher-cost short-stay accommodations.

In contrast, having more time to travel (and traveling slowly as a result) and flexibility on where I travel (not just to expensive cities like Paris, London, and Tokyo), I have found that I can keep my expenses within just about any budget level. By renting out our house long-term, we only pay for lodging once per night—that makes our budget go further and increases our destination options. By renting places for at least 28 days we have enjoyed monthly discounts of up to 60% on popular accommodation platforms.

I have learned a lot about myself becoming a minimalist and traveling nomadically over the last two years. I found more life satisfaction by shifting from the elusive pursuit of happiness to the achievable pursuit of contentment. I don’t try to skim by the world to reach a high country count or to claim I “saw” something. Instead, I focus on experiencing the places I do visit more deeply—going below the surface as much as I can.

We each have different travel styles and preferences and your priorities will most likely be different than mine. Even so, if you are considering extended travel, I hope you have found something useful in these insights.

These 10 things I’ve learned from my nomadic travels have improved my enjoyment of travel and, I think, kept me from travel burnout. I look forward to the next two years of travel!