I often hear (and read) discussions about choosing either the military Survivor Benefit Plan (SBP) or term life insurance to ensure the surviving spouse remains financially secure. This is comparing the wrong two things! (And any comparison of either with permanent (aka “whole”) life insurance is way off course.)

While both term life insurance and the SBP are insurance products, they are designed for different purposes. When deciding whether to elect the SBP insurance at retirement, the question is not whether the SBP insurance is a better financial choice than term life insurance, but whether the expected payouts from SBP will exceed the expected monetary gains from long-term investing of the SBP premiums (i.e., the opportunity cost of buying SBP insurance).

When I was retiring from the Air Force after 20 years, my wife and I were surprised by the cost of the monthly SBP premiums (6.5% of gross pay adjusted annually for inflation). We evaluated the potential investment gains from investing the same amount into low-cost index funds and decided not to purchase the Survivor Benefit Plan insurance. We chose self-insurance instead with no regrets.

To decline SBP, my wife had to physically accompany me and sign a notarized statement that she understood the decision and agreed to forgo the benefits. Below I walk through the numbers we ran to support this decision.

Expected Investment Return Calculation

At our retirement in 2011, our spouse SBP premium would have been $248 per month (6.5% of $3,809). The SBP premium increases each year for inflation. We used 3% as our average annual inflation rate (in 2025 the $248 premium would be an estimated $357 a month!)

To calculate our projected investment returns, we used the average annual inflation adjusted stock market return since 1926—which I determined was 7.3% at the time (market performance since I retired has been much better with 10% inflation adjusted returns, so the numbers used in this post are way below what actually happened). I then calculated our projected returns for 30-, 40-, and 50-year investment horizons.

Our estimated 30-year investment return came to $434K. After 30 years (age 72) SBP premiums are no longer taken out. After 40 years (age 82), and without additional contributions, the investment is expected to grow to $878K, and grow to $1.8 million by age 92 (50 years).

Again, these are inflation adjusted numbers, so the buying power remains constant over time to enable comparison. As you can see, the power of compounding doubled our money at each 10-year milestone.

We understand that past market performance is no guarantee of future results; likewise, actuarial tables do not predict individual outcomes. But both provided us with helpful planning factors. We are strong believers in compound interest and know that our investment horizon will continue long into our retirement years.

Actuarial Assessment

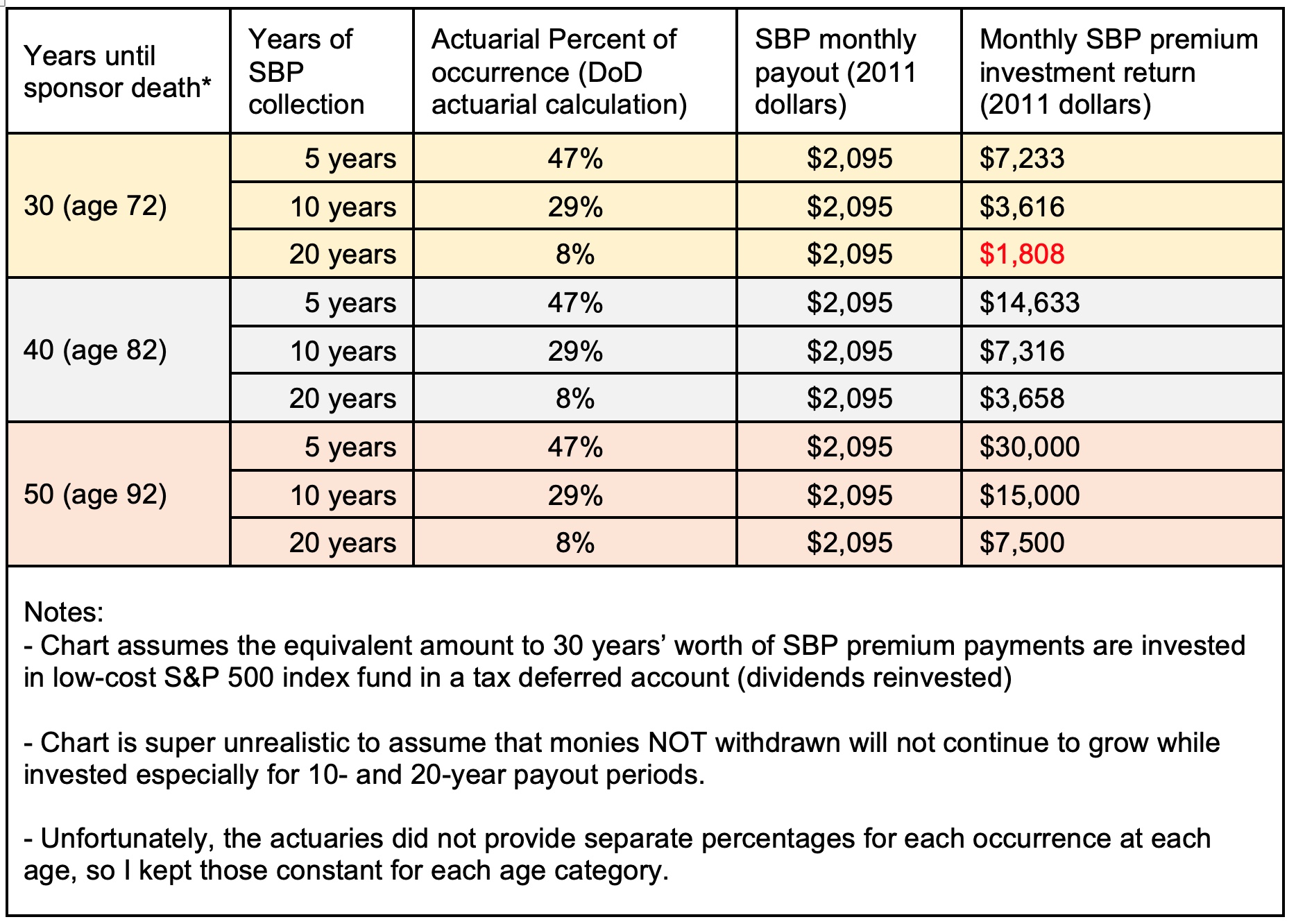

The DoD-provided SBP actuarial analysis tools (specifically the “SBP Probability” calculator) predicted my spouse would have a 47% chance of collecting 5 years of SBP benefits, a 29% chance for 10 years, and an 8% chance for 20 years. (I highly recommend reading Annie Duke’s book Thinking In Bets to understand how to make better decisions regarding probabilities)

These odds are not very high in our opinion, especially when you consider that if my spouse dies first, we get zero ($0) of the payout and zero ($0) of the premiums spent back.

Expected Payout Comparisons

Assuming I pass away 30 years after retirement, the $434K gain from investment would conservatively yield a monthly payout of $7233 over 5 years and $3616 over ten years (both unrealistically assuming no further growth, so these are overly conservative), while the SBP is projected to pay $2095 ($3,089 * 55%) a month.

Both payouts, SBP and our investments, are inflation adjusted (i.e., represent equal buying power) and would be taxed the same since we put the money in tax-deferred accounts (see note below on how we did that).

We felt that the 8% to 28% chance of a longer term SBP payout was less likely than a scenario in which I live well past age 72. Every additional year compounds the investment growth, while the SBP payout stays the same (again, both are adjusted for inflation).

If I lived 10 more years, the $878K accumulated investment would far exceed the $2095 monthly SBP payment, and 10 years beyond that is an insane difference. See table below.

The decision to decline spouse SBP is situationally based, so everyone should run their own numbers and assess their own risks. In many cases SBP can be a great choice. For example, the calculation likely would be different if you stayed on active duty for 30 years or if your spouse was significantly younger than you.

Both the SBP and term life insurance are insurance products, but they are different products. They are designed for different purposes and should not be compared head-to-head, but as part of a larger retirement plan.

Yeah, but what about a worst-case scenario?

We did plan for a worst-case scenario (e.g., an early death of the retiree) as it would be too costly to bear for the first 10 years. We needed to make sure my spouse was covered until we could build a portfolio that would ensure her support if I predeceased her too early (a very low risk scenario, but with high impacts).

We hedged against these risks in four primary ways (1) with the Child SBP, (2) with a 30-year term $500K life insurance policy that would cover our house mortgage (plus some extra), (3) delaying taking my Social Security to age 70 for maximum surviving spouse benefits, and last but not least (4) all of our other investments and workplace insurance — both hers and mine (I’m not discussing those here in full, but I didn’t want to completely ignore options that will cover a worst case). And remember, a worst case the other direction, that the spouse dies the day after the last SBP premium payment, favors declining Spouse SBP.

Our SWAN (sleep well at night) SBP declination decision was based on our entire financial picture and not just the SBP decision in a vacuum.

Child SBP Option

We did purchase the low cost $10.28 per month child SBP coverage to hedge against a worst-case scenario for our kids if I died early and in return, we received 12 years of coverage (until my youngest reached age 22 in college). This allowed us time to get our investment seeded and put other financial support in place. This was a decision we would have made whether we purchased the spouse SBP insurance or not as we needed to financially protect against my wife and I both dying early and needing funds to support our children until they finished college.

Term Life Insurance

If I pass away before 30 years, with the term life insurance hedge, my wife’s housing costs (our inflation stable mortgage payment) would drop by two thirds. With the returns after 12 years of investing (length of child SBP coverage), the combination would more than offset the missing SBP payments.

To be clear, term life insurance, as a hedge against an early death of the retiree, is often an important part of the broader retirement decision matrix, but it was not our primary consideration for making the cost comparison for our SBP decision.

There are other reasons to consider getting term life insurance. Life insurance is a separate part of our retirement plan intended to pay off our house mortgage (in the event of my early death) that we would purchase whether we took SBP or not. Since my wife was employed in a stable job, she could continue to work to pay the rest of the expenses not covered by the insurance payout.

Conclusion

If I outlive the 30-year life insurance policy (that’s the plan!), the house will be paid off AND the investment returns of the SBP premiums will self-insure us to more than cover what the SBP would have (and much more, the longer I live). On the flip side, if we took SBP and she predeceases me after 30 years, we would lose out on the entire $417K+ potential investment.

The risks go both ways. We didn’t let the fear of the low percentage risk of an early death for me drive our decision, but we also had a viable contingency plan to ensure that my wife would still be financially solvent for the long term. We of course made this decision based on our entire retirement plan (e.g., term life insurance, her work pension, Social Security, investments)—not just SBP in isolation. For us, looking back 11 years, we don’t regret our decision to turn down SBP in the slightest.

Update August 2025: after 14 years, all of our investments, SBP premiums and otherwise, has far exceeded our projected 7.3% investment return and compound interest has worked its magic (we achieved a 10% inflation adjusted return so far!). We have both retired early at age 52 and are self-insured with our real estate and other investments (and I still have my term life insurance for another 16 years). Since our investments far exceed any of our calculations above, we can now pocket and spend the now $357 (and growing due to inflation) monthly SBP premium if we want — nice passive income that we wouldn’t have if we let fear drive us to buy SBP insurance. The horse race was over long-before we needed to invest the remaining 16 years of projected SBP premiums—a Financial Independence Retire Early (FIRE) life is a great life!

Note on actuarial tables: The actuarial table provided didn’t include options to add health conditions and family health history, which could put any couple above or below these projected numbers. My longevity was predicted as higher than my spouse using more detailed calculators—this supported our personal decision to decline the SBP.

Note on taxes: While the SBP premiums are pre-tax, our investment of those funds were not necessarily post-tax monies when taking the entire income and tax picture into account. We invested these monies in long-term equities in a tax-deferred account.

Technically we paid tax on the earnings, but since my wife and I have access to TSP, 403b, and 457b accounts, we needed the cash flow to allow us to fully utilize these tax-deferred accounts, so, while the SBP premium money is taxed, it can be (and was in our case) offset by tax-deferred investments if you have tax-deferred account investment ceiling to work with.

One more note on taxes: Life insurance payouts are generally not taxed, so while the term insurance payout does not adjust for inflation, the payout is net of taxes whereas SBP payouts are taxed as income. By pledging our term-insurance payout to our mortgage, I believe we mitigated the inflationary impacts. The P&I portion of the mortgage payment stays the same over the life of the loan, so the insurance retains its purchase power for its intended purpose to pay off the house. The longer I live (up to the end of the mortgage term), the more residual money from the insurance will remain after paying off the house, which could also be invested. This potential investment opportunity was not part of our SBP decision.

Thanks for reading! If you would like to be notified of new posts or updates from Living The FIgh Life, please subscribe below. I am an inconsistent blogger (hey, I'm retired!) so this is the best way to be notified of new content. Cheers!

![]()