Several prominent early retirees have shared their challenges with life-changing events to include divorces, major medical surprises, and death of a spouse. While these events have a low chance of occurring for most early retirees, the impact of these events could derail our retirement plans. Some early retirees had to return to full-time employment as their passive income no longer covered their expenses. But others had a strong enough financial picture to weather the significant cut in net worth from a divorce, loss of a pension from a spouse’s death, major medical expenses, or unplanned expenses from life changes like getting married and having children. To minimize the impact of unplanned events on our retirement plans, we need to stress test our plans before we retire. While we can’t (and shouldn’t) plan for every possible scenario, having a good idea of our financial options will help us sleep better as we take the leap into early retirement.

Using our current expenses to figure out our financial independence number is a great place to start. As we get closer to achieving financial independence though, we need to refine our projections to account for projected expenses in retirement. The earlier you retire, the harder it will be to get a good handle on these expenses over time. Stress testing for common unplanned events will help.

Before I quit my job and retired early 5 years ago, I first figured out the safe withdrawal rate from our investments and what that would provide in combination with real estate income, pensions, and Social Security (I found this tool by Karsten Jeske at his Early Retirement Now blog to be very helpful in this regard). After that, I ran numerous scenarios to test if my and my wife’s retirement plan would handle major life changes. We needed to know if our retirement would be torpedoed if one of us died unexpectedly early, we got a divorce, had a major health challenge, or other major change in our lives. I had a good estimate of what our projected income would be and knew it would cover our projected known expenses, to include inflation. But I still needed to see how a major unplanned event might impact our plan.

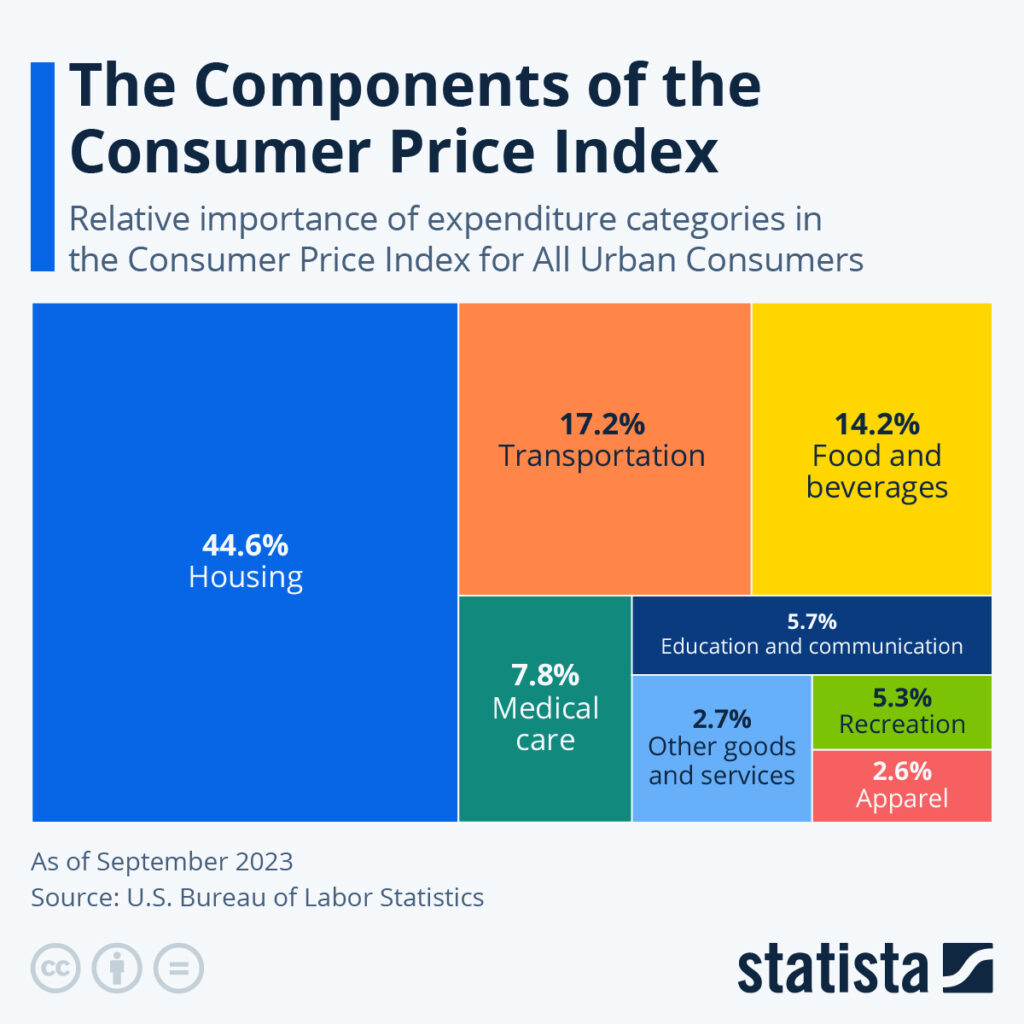

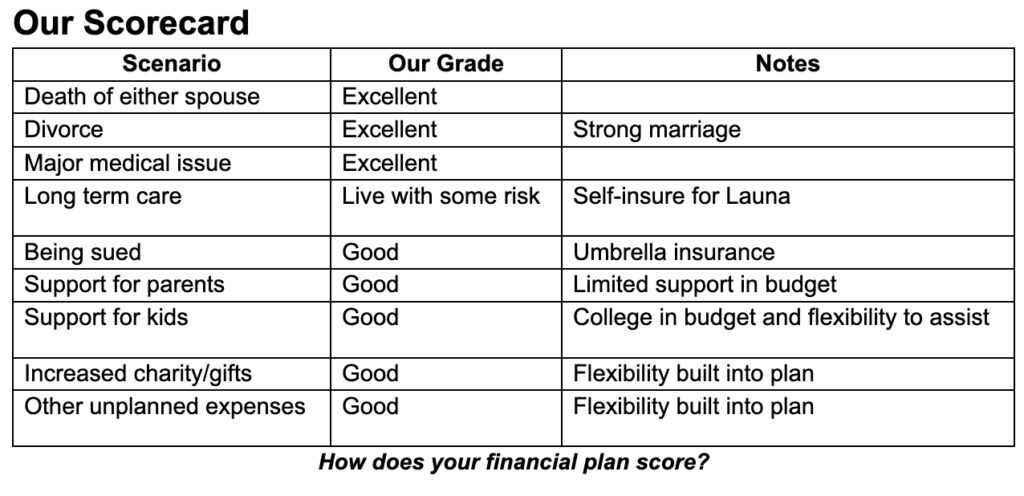

For each of the scenarios below, I conservatively adjusted income and expenses, and assessed how well our adjusted income covered the adjusted expenses. Then I graded how well our financial plan would hold up for each with “Excellent,” “Good,” “Live with some risk,” or “Failing” (i.e., postpone retirement and keep saving). My scenarios are aimed at capturing 80% of worst case scenarios. Trying to cover the rarest and most catastrophic of situations, particularly for medical expenses, would prevent us from ever retiring, and I’m not interested in living with that level of fear.

While every person’s situation is different, hopefully my thought process for stress testing our plan through several scenarios will help you better evaluate your own retirement plan.

Early death of either spouse

We wanted to make sure that if one of us passed away that the other person would be financially sound. For joint accounts, if one spouse passes away then the other spouse will generally retain full ownership of the accounts. In our case, if my wife died, all of our assets would remain with me as I am her beneficiary. However, if I died, my military pension and VA disability benefits would disappear as Launa and I smartly turned down the military’s Survivor Benefit Plan. Because of this we made sure we had enough passive income from investments, real estate, and maximum social security to cover her projected expenses (to include higher taxes filing single). We also bought a term life-insurance that would cover our primary house mortgage to hedge against my early death before we had enough invested. If I died tomorrow, she would be financially set because she is individually financially independent. Grade: Excellent.

Divorce

Launa and I have been married for 35 years and going strong, but we still needed to stress test our plan for this unlikely possibility. If you have combined finances as we do, it can be easier to achieve a shared FI number together primarily due to shared expenses. But if the portion of assets and income each person would get after a divorce won’t cover each person’s expected individual expenses, then the FI plan won’t fully support a divorce. For us, we ensured that each of us was separately financially independent before retiring. Divorce can get complicated, especially if lawyers get involved, but for our stress test, we compared splitting our assets down the middle (including my military pension) with projected expenses for us both being single. While our single lifestyles wouldn’t be as well-funded as we currently have sharing expenses, we would both remain financially independent without needing to return to work. Grade: Excellent.

Major medical issue

With the high-cost of medical care, even with insurance, a major medical issue can cost a lot of money. These are hard to plan for and the costs can be astronomical. Assessing family medical history and understanding the limits of your medical insurance will help identify what type of deductible and cost shares you may be responsible for. As with my safe withdrawal rate, planning for 100% coverage of all possible situations is not worth it for us. Reading Annie Duke’s book Thinking In Bets really helped me prevent letting fear of a worst case scenario drive my decisions, not just for medical situations, but for our retirement and other life situations. Because Launa and I have military healthcare, our costs are currently capped and our retirement plan includes funding for the insurance and cost-sharing amounts. Grade: Excellent

Long term care

Long term care (LTC) is the boogie man of retirement planning. Insurance companies are happy to sell me LTC insurance at an exorbitant rate that generally increases significantly the older I get and closer I am to actually needing care. Insurance is a money-making business and they use highly refined actuarial analysis to determine the costs so that they reduce their exposure to claims and maximize profits. Much like financial independence, we have options when it comes to LTC. For example, when my aunt, who lived in Florida, needed nursing home care in 2020, she was accepted into a beautiful home in Georgia for 1/3 of the price that any comparable nursing home in Florida would cost. Her daughters shopped around and saved a fortune. We plan to age in place as long as possible. Since we will not be traveling by then, we plan to spend our travel money to hire a caregiver to assist in our home with daily non-medical care as needed, minimizing the amount of time we would need a full-time care facility.

I also have LTC coverage through Veterans Affairs, so I can fall back on that if my condition is too difficult for Launa to handle. Bottomline, we decided to self-insure instead of buying costly LTC insurance. While the cost of LTC could be exorbitant, we plan to be flexible in our options and, barring a divorce, our dual financial independence plan gives us extra financial flexibility. Grade: Live with some risk (we can sleep at night)

Being sued

We carry auto liability insurance for the rare times we drive and liability insurance on our two rental properties. Even so, we are still exposed to a possible lawsuit if someone is injured on our properties or if we are in a car accident. While IRA and tax-deferred accounts are generally safe from such lawsuits, our rental properties and other accounts aren’t. To help protect our financial future from this possibility, we purchased umbrella insurance to cover the total value of our vulnerable assets. In addition to the financial coverage, we also get a team of lawyers from our insurance company in our corner helping us fight against any suits. Umbrella insurance was surprisingly affordable and worth every penny. Grade: Good

Other scenarios

There are many other possible events that could have a big impact on our early retirement plan such as support for aging parents, unplanned kids’ expenses, and increased charity donations.

If you are single, getting married could have a big impact on your finances both positive and negative. Similarly, having a child after early retirement will impact your financial plan. Over time our priorities tend to shift. We may not want to get married or have kids now, but that could change. In our case, our desire to give more in gifts (to family and to charity) has grown over the past few years that we hadn’t considered when we started our financial journey 30+ years ago.

When looking to retire early, think through the possible life changes and what amount of financial support will result. Having a child could mean more healthcare costs, possible college support, and other expenses like childcare, braces, and club sports. Building those expenses into your financial plan will ensure a higher level of success for early retirement.

Launa and I increased our planned expenses to include financial support for my mom. This increased our FI number and delayed our retirement, but we are glad to assist with her quality of life. For our kids, we had it fairly easy since our kids were both off to college when we retired. We had set aside money for their college tuition (both were inflation protected) so we weren’t surprised by the cost and they both graduated without college debt.

Our retirement budget also included money for our kids to travel with us each year (part of our nomadic travel plan), some generous gifts for them, our family, and charity, and the ability to financially assist our kids if they request help. Much of this was made possible because our dual financial independence plan gave us extra financial flexibility. Grade: Good

We can’t let fear keep us from enjoying our early retirement. We don’t need to solve for 100% of potential problems. By stress testing our financial plan to solve for at least 80% of the most likely financial derailing scenarios, we can feel assured in ourselves and let go of the anxiety that is keeping us stuck in the “one more year” syndrome and preventing us from taking the joyous leap into early retirement.